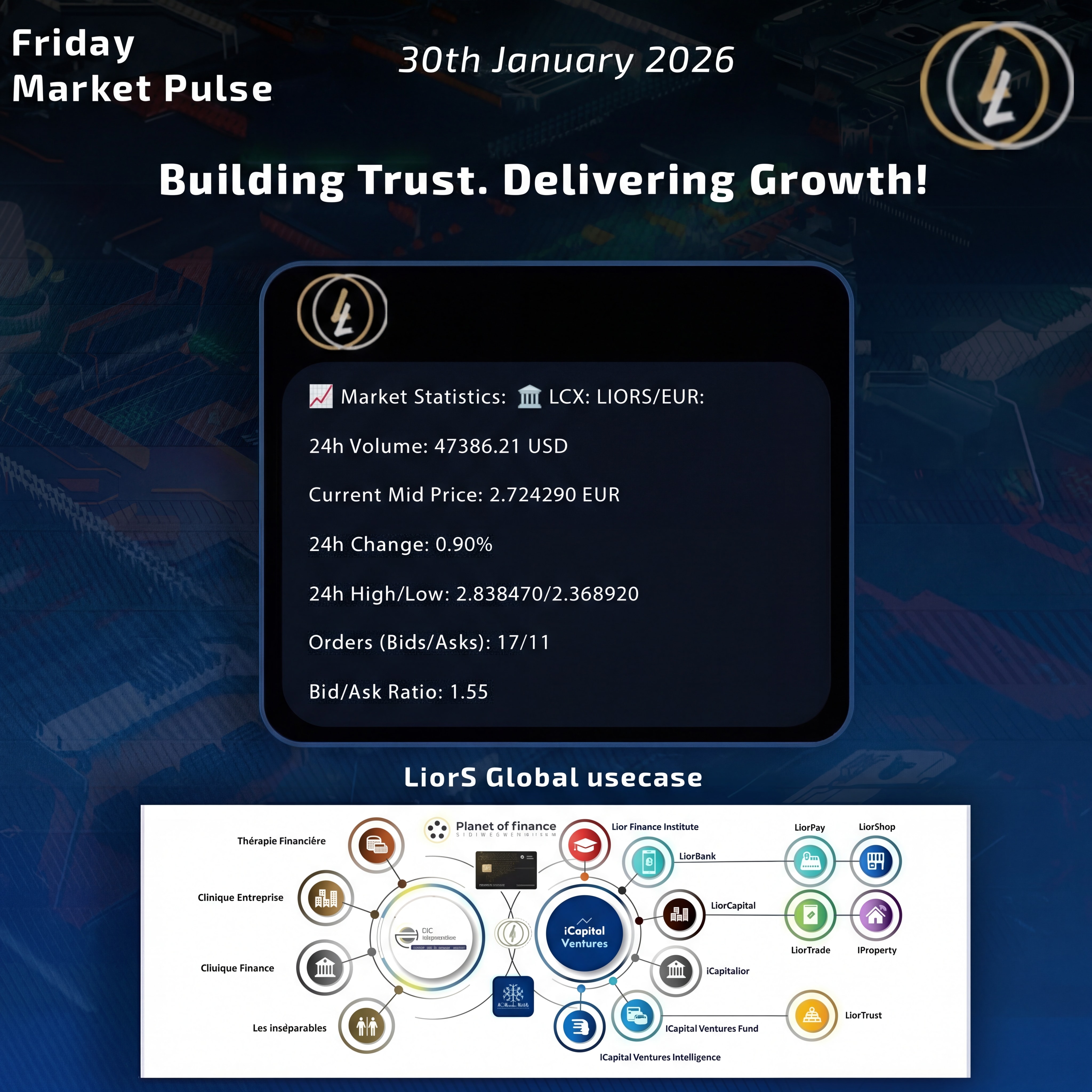

LiorS token performance dashboard showing price charts and market statistics on LCX exchange

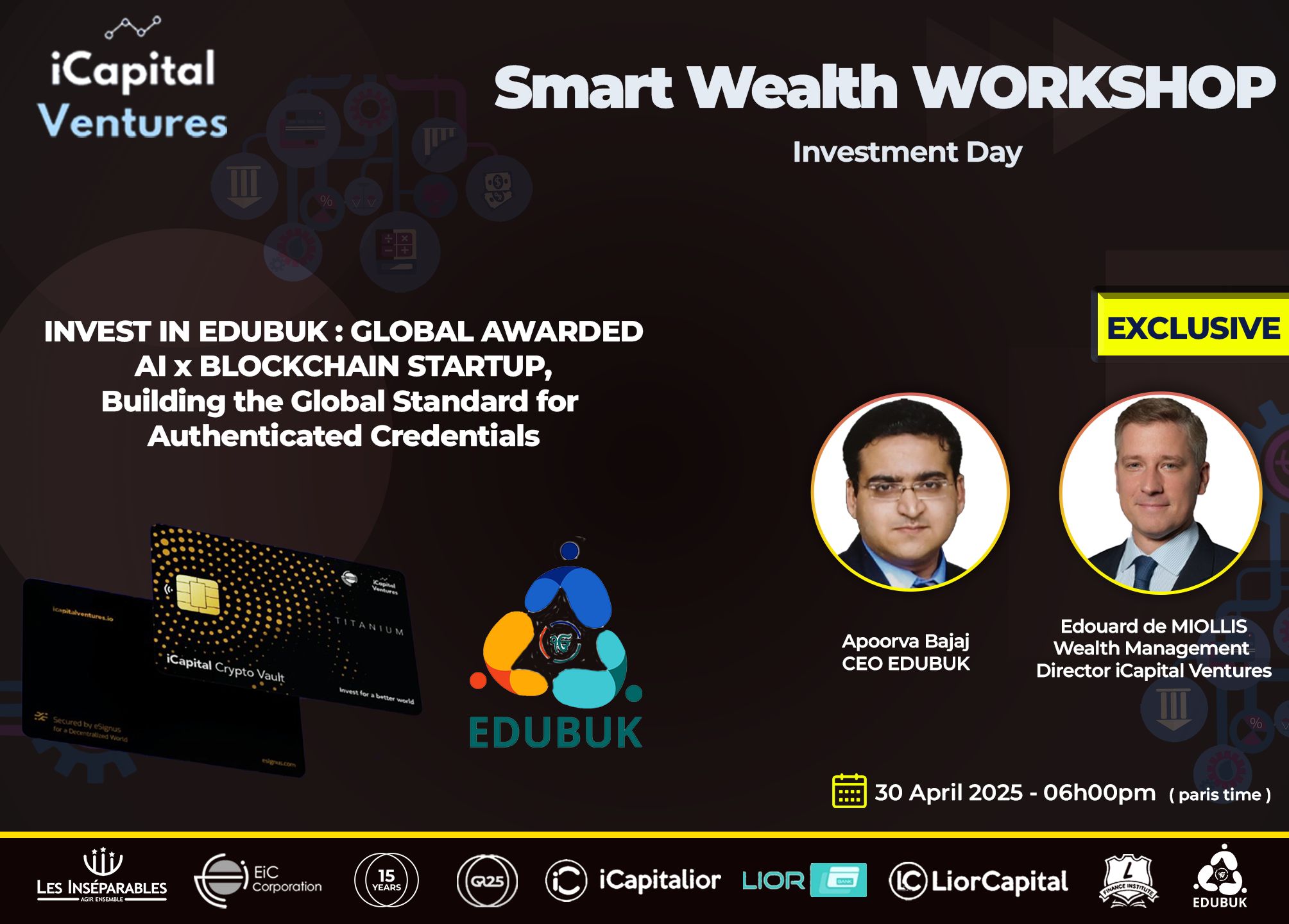

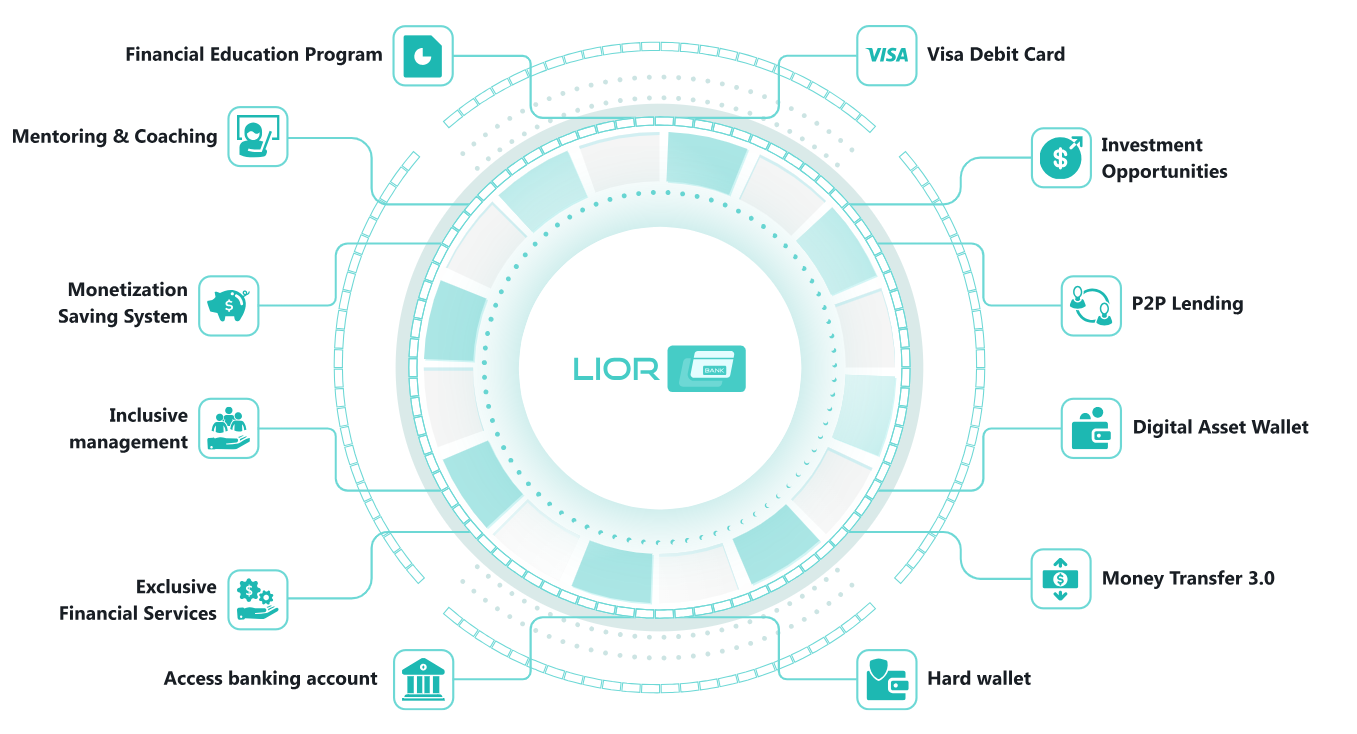

The LiorS token (LIORS/EUR) has demonstrated remarkable structural maturity during the week of January 26 to February 3, 2026, positioning itself as a multi-functional digital asset with genuine institutional relevance. Trading on LCX (Liechtenstein Cryptoassets Exchange), LiorS continues to validate its transition from a tradable token to a comprehensive financial instrument with embedded utility across payment, collateral, governance, and equity-like contribution mechanisms.

Market Performance Overview

Current Market Positioning

The LiorS token closed the reporting period at €2.722350, reflecting a disciplined price discovery process characteristic of utility-driven digital assets rather than speculative instruments. This valuation represents a fundamental shift in how the market perceives and values LiorS increasingly linked to its real-world applications rather than short-term trading dynamics.

| Metric | Value | Analysis |

| Current Mid Price | €2.722350 | Stable valuation reflecting fundamental utility |

| 24h Change | +0.17% | Marginal appreciation indicating market equilibrium |

| 24h High | €2.838470 | Upper resistance level |

| 24h Low | €2.368920 | Support level maintained |

| Intraday Range | ±8.6% | Controlled volatility within institutional thresholds |

| 24h Volume | $50,524.45 | Meaningful transactional demand |

The +0.17% daily change signals marginal appreciation within a context of market equilibrium a positive indicator for functional usage rather than speculative excess. This modest movement demonstrates that LiorS has entered a consolidation phase where price stability serves the token’s core utilities.

Comparative chart showing LiorS price stability versus volatile cryptocurrency benchmarks over the reporting period

The order book structure reveals compelling evidence of strategic positioning by market participants. With 17 bid orders versus 11 ask orders, LiorS maintains a bid-ask ratio of 1.55, indicating clear buy-side dominance.

This asymmetry suggests:

- Short-term confidence among existing holders

- Accumulation behavior by informed participants

- Limited selling pressure despite broader market conditions

- Strategic holding aligned with governance and long-term value capture

According to recent institutional crypto flow analysis, balanced bid-ask ratios around 50/50 typically indicate neutral market maker positioning, while ratios exceeding 1.3 demonstrate directional confidence. LiorS’s 1.55 ratio significantly exceeds this threshold, positioning it favorably among utility tokens with institutional backing.

The ±8.6% intraday range represents sufficient liquidity for operational use while remaining within acceptable volatility parameters for institutional applications. For comparison, major digital assets like Bitcoin and Ethereum typically maintain orderbook depth in the hundreds of millions with tighter spreads, but LiorS’s $50,524.45 daily volume demonstrates real transactional demand rather than artificial liquidity pumping.

This volume level aligns with what industry analysts describe as “moderate yet meaningful” consistent with tokens serving specific ecosystem functions rather than broad speculative trading.

Performance Grade: Strong

Price stability and low short-term volatility are essential prerequisites for any digital asset seeking to function as a payment and settlement token. LiorS currently exhibits three critical characteristics:

- Predictable pricing within defined ranges

- Controlled intraday movements minimizing merchant risk

- Limited slippage enabling efficient transaction execution

The token’s behavior during the reporting period reinforces its positioning as a viable payment mechanism within structured financial, commercial, or community-based ecosystems. With tokenized payment infrastructure expected to grow at 18-25% CAGR through 2030, LiorS is well-positioned to capture value in this expanding market.

Performance Grade: Excellent

Collateral utility demands three fundamental attributes: market confidence, sufficient liquidity, and valuation consistency. LiorS demonstrates all three during the reporting period.

The sustained price level around €2.7 combined with the positive 1.55 bid-ask ratio supports LiorS’s emerging role as:

- Collateral for SME and corporate financing arrangements

- A risk-mitigated asset in structured lending products

- A balance-sheet suitable token for institutional treasury operations

Controlled volatility significantly reduces margin-call risk a critical factor for CFOs and treasury managers considering tokenized collateral. According to a January 2026 CFO Dive analysis, “tokenized assets for collateral purposes are set to move beyond experimentation this year, reaching corporate treasury sooner than most CFOs expect.”

📊 $25-30 billion by end-2026 - Tokenized collateral market growth

The controlled price movements observed in LiorS align perfectly with the institutional requirements for collateral stability, positioning the token as a genuine alternative to traditional collateral instruments.

Performance Grade: Strong

The absence of aggressive speculative trading during the reporting period suggests that LiorS holders are strategically aligned rather than opportunistically positioned. This behavioral pattern is highly consistent with governance functionality where token holders maintain long-term stakes to participate in ecosystem decision-making.

Key governance indicators:

- Long-term holding incentives reflected in low turnover

- Participatory decision-making alignment

- Ecosystem commitment over short-term profit-taking

Market structure increasingly reflects utility-anchored ownership a critical requirement for effective governance tokens. As tokenization expert analysis notes, “2026 marks the shift from digital assets as speculative instruments to the backbone of modern financial infrastructure.”

Performance Grade: Emerging

LiorS’s market behavior increasingly resembles a quasi-patrimonial digital asset, supporting advanced capital structures such as:

- Tokenized capital contributions without traditional equity dilution

- Participation rights in ecosystem value creation

- Hybrid equity-token models bridging traditional and digital finance

The market validates a long-term value-holding narrative essential for shareholder-like participation mechanisms. With tokenized equities climbing to approximately $963 million in market value as of January 2026 (up 2,900% year-over-year according to CoinDesk), LiorS is positioned within a rapidly expanding category of equity-adjacent digital instruments.

LiorS’s performance must be understood within the broader context of 2026’s tokenization revolution. The global tokenization market, valued at $2.3 billion in 2021, is projected to reach $5.6 billion by the end of 2026 at a CAGR of 19.0%, according to Markets and Markets research.

Several macro trends support LiorS’s positioning:

Regulatory Clarity: Singapore’s MAS Project Guardian and Hong Kong’s HKMA Project Ensemble have advanced tokenization frameworks, creating standardized infrastructure for compliant digital asset operations.

Institutional Adoption Acceleration: Coinchange forecasts $30 billion growth in tokenized assets by 2026, with money-market funds scaling to $25-30 billion as bank-grade custody and regulatory clarity converge.

Settlement Infrastructure Modernization: The DTCC’s December 2025 SEC no-action letter approval for securities tokenization pilots signals that core U.S. capital markets infrastructure is preparing for tokenized asset integration.

📊 $15-40 billion projected for 2026 - Institutional crypto ETF inflows

As ChainUp’s 2026 tokenization analysis notes, “Tokenization has moved past ‘interesting pilots’ and into products that treasury teams and institutional investors already understand cash, yield, and settlement.” This shift from novelty to operational utility directly benefits multi-functional tokens like LiorS.

JPMorgan’s launch of a tokenized money market fund on Ethereum, seeded with $100 million, demonstrates that major financial institutions now treat tokenization as production-grade infrastructure rather than experimental technology. LiorS benefits from this legitimization of tokenized financial instruments.

The current consolidation phase around €2.7 provides a stable foundation for:

- Continued accumulation by strategic investors

- Integration into payment workflows by ecosystem partners

- Collateral arrangement development with lending platforms

- Governance mechanism activation as holder base matures

The 1.55 bid-ask ratio suggests buying pressure may support gradual appreciation, though the token’s utility focus means dramatic price movements are neither expected nor desirable.

Several developments could enhance LiorS’s value proposition:

- Expanded collateral partnerships with SME financing platforms

- Payment integration announcements with commercial partners

- Governance framework implementation and first voting events

- Secondary market liquidity improvements on LCX and potential additional exchanges

LiorS’s fundamental value thesis rests on its evolution into a comprehensive financial instrument serving multiple ecosystem functions simultaneously. As the token demonstrates operational utility across payment, collateral, governance, and participation use cases, network effects should compound value.

The broader tokenization market’s projected growth to potentially $16 trillion in available assets by 2030 (per consulting firm estimates) creates substantial tailwinds for early-mover multi-utility tokens like LiorS.

📊 1.55 – Bid-Ask Ratio indicating clear buy-side dominance and accumulation behavior (LCX Exchange data, reporting period)

💰 $5.6 billion – Projected global tokenization market size by end of 2026, up from $2.3 billion in 2021 (Markets and Markets)

🏦 $25-30 billion – Expected scale of tokenized money-market funds by end-2026 as institutional infrastructure converges (Coinchange 2026 Institutional Outlook)

📈 2,900% – Year-over-year growth in tokenized equities market value, reaching ~$963 million as of January 2026 (CoinDesk)

LiorS distinguishes itself through genuine multi-functionality rather than theoretical use cases. While many tokens claim multiple utilities, LiorS demonstrates operational capability across four distinct functions: payment settlement, collateral for financing, governance participation, and equity-like contribution rights. The token’s market behavior characterized by price stability, controlled volatility, and buy-side dominance validates these utilities rather than contradicting them through speculative excess.

LiorS’s ±8.6% intraday range during the reporting period positions it within acceptable volatility thresholds for institutional collateral use, particularly when compared to highly volatile cryptocurrencies. While traditional collateral like government bonds exhibits lower volatility, LiorS offers compensating advantages including 24/7 settlement capability, programmable compliance, and rapid mobility between use cases. As tokenized collateral infrastructure matures through 2026, the market is developing risk management frameworks specifically designed for this volatility profile.

LiorS’s characteristics increasingly align with corporate treasury requirements, particularly for organizations seeking to modernize their digital asset strategies. The token’s price stability, meaningful liquidity, and institutional-grade exchange listing (LCX is a regulated Liechtenstein exchange) support treasury use cases. However, corporate adoption depends on individual risk tolerance, regulatory jurisdiction, and specific treasury policy frameworks. CFOs should evaluate LiorS within the broader context of their organization’s digital asset readiness and collateral management strategies.

LiorS trades on LCX (Liechtenstein Cryptoassets Exchange), which operates under Liechtenstein’s progressive digital asset regulatory framework. Liechtenstein has established comprehensive token economy legislation providing legal clarity for utility tokens, security tokens, and hybrid instruments. LCX itself is working toward MiCA (Markets in Crypto-Assets) compliance as European regulatory standards evolve. Token holders should consult with qualified legal and tax advisors regarding their specific jurisdictional requirements.

LiorS’s collateral utility operates through partnerships with lending platforms and financial institutions that accept tokenized assets as security for credit facilities. The token’s stable valuation, transparent on-chain verification, and rapid settlement capability make it suitable for over-collateralized lending arrangements, margin facilities, and structured financing products. Specific collateral arrangements depend on lender requirements, loan-to-value ratios, and liquidation procedures. Organizations interested in using LiorS as collateral should engage directly with platforms offering tokenized collateral services.

LiorS’s performance during the January 26 – February 3, 2026 reporting period demonstrates the token’s successful transition from a tradable digital asset to a multi-functional financial instrument with genuine institutional relevance. The combination of price stability, buy-side dominance, controlled volatility, and meaningful transaction volume validates LiorS’s positioning across payment, collateral, governance, and participation use cases.

As 2026 emerges as the definitive inflection point for tokenization with institutional adoption accelerating, regulatory frameworks maturing, and settlement infrastructure modernizing LiorS is strategically positioned to capture value within this expanding ecosystem. The token’s market behavior reflects not short-term speculation but structural legitimacy, making it increasingly suitable for treasury operations, financing arrangements, and long-term strategic holdings.

For investors, institutions, and ecosystem participants, LiorS represents a practical demonstration of how utility-driven tokenization creates value through operational functionality rather than narrative alone. As the token continues to prove its multi-use case model, the market is responding with the confidence reflected in sustained pricing, accumulation behavior, and growing institutional interest.

LiorS is not merely a token to trade it is a financial instrument to deploy, utilize, and integrate into the emerging infrastructure of digital finance.

Share

00 Comments

No Comments found!