Between February 3 and February 10, 2026, the LiorS (LIORS) token demonstrated a market behavior pattern that signals a fundamental shift in its positioning—from a speculative digital asset to a functional utility token with genuine institutional relevance. Trading on the Liechtenstein Cryptoassets Exchange (LCX), LIORS exhibited the rare combination of surging trading volume alongside remarkable price stability, a phenomenon that typically indicates growing functional adoption rather than speculative trading dynamics.

This comprehensive performance analysis examines the market statistics, interprets the behavioral patterns through the lens of LiorS’s multi-functional use cases, and assesses what these signals mean for institutional and retail participants in the evolving digital asset ecosystem.

The week of February 3-10, 2026, marked a critical inflection point for LIORS, revealing market maturation characteristics that distinguish utility-driven tokens from purely speculative assets.

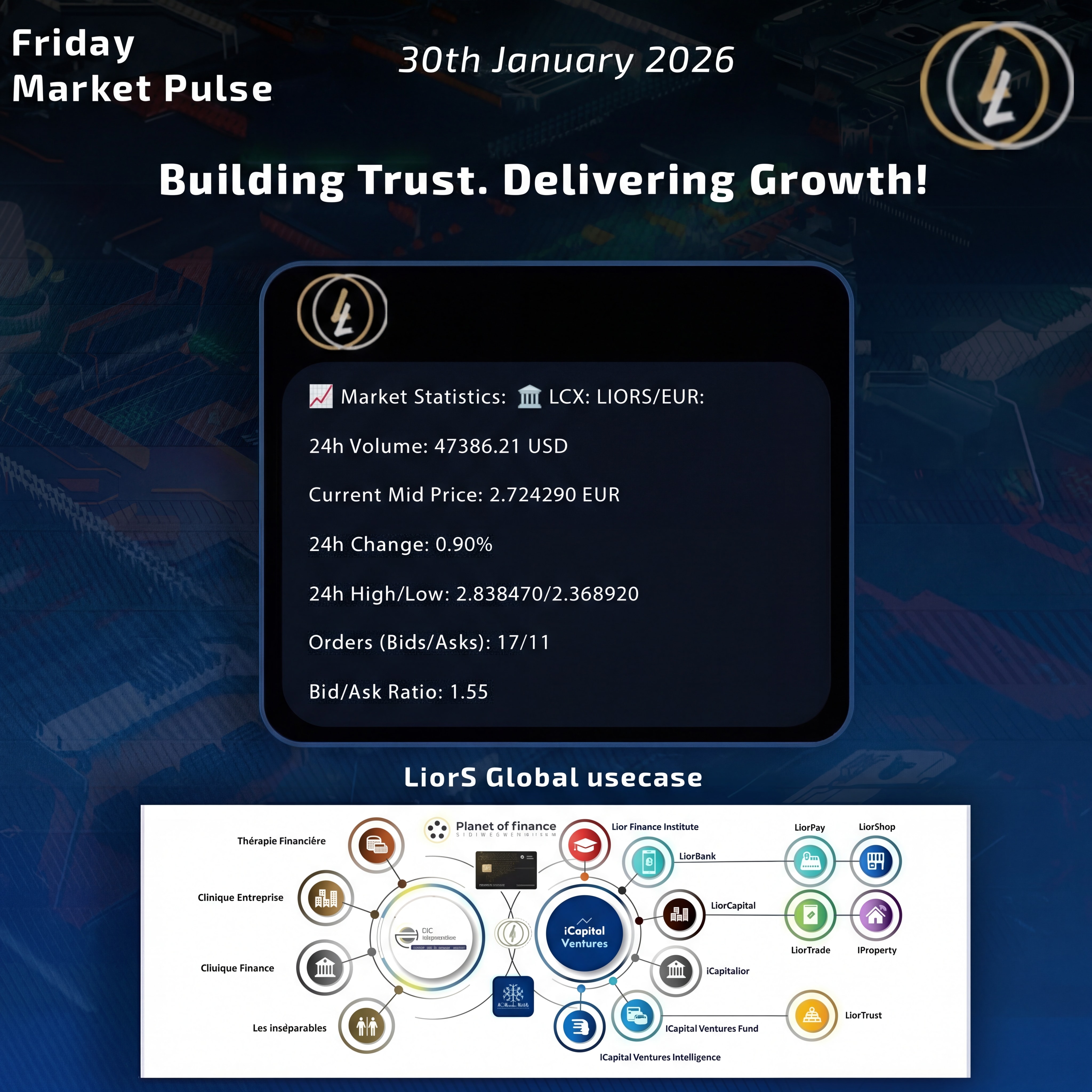

| Metric | February 3, 2026 | February 10, 2026 | Change |

| 24h Trading Volume | USD 50,524 | USD 130,272 | +158% |

| Mid Price | €2.7223 | €2.7061 | -0.6% |

| High Price | €2.84 | €2.75 | -3.2% |

| Low Price | €2.37 | €2.68 | +13.1% |

| Price Range | €0.47 | €0.07 | -85.1% |

| Bid/Ask Ratio | 1.55 | 1.43 | -7.7% |

📊 +158% in 7 days - Trading Volume Surge

The most striking feature of this performance period is the simultaneous occurrence of a 158% increase in trading volume alongside a minimal 0.6% price adjustment. In traditional cryptocurrency markets, volume surges of this magnitude typically correlate with price volatility exceeding 10-20%. The fact that LIORS absorbed this increased activity while maintaining price stability signals a fundamental shift in market structure.

According to research from Amberdata’s 2026 institutional crypto flows analysis, “volume confirmation on consolidation suggests accumulation rather than distribution—constructive for continuation once resistance clears.” This principle applies directly to LIORS’s recent performance.

The narrowing of the High/Low price range from €0.47 to €0.07 represents an 85% reduction in intraday volatility. This compression pattern is particularly significant when viewed against broader crypto market trends in 2026.

As noted in Kaiko’s 2026 market structure analysis, “crypto markets enter 2026 in a markedly different position than in prior cycle transitions, progressing through a phase of institutional consolidation where regulatory clarity and stablecoin-led liquidity play larger roles in price formation than narrative-driven retail flows.”

“Crypto in 2026 looks less like a new cycle and more like continued institutionalization” — Kaiko Research

LIORS’s behavior aligns with this broader institutional consolidation trend, suggesting that the token is transitioning from a price discovery phase to a utility-driven valuation phase.

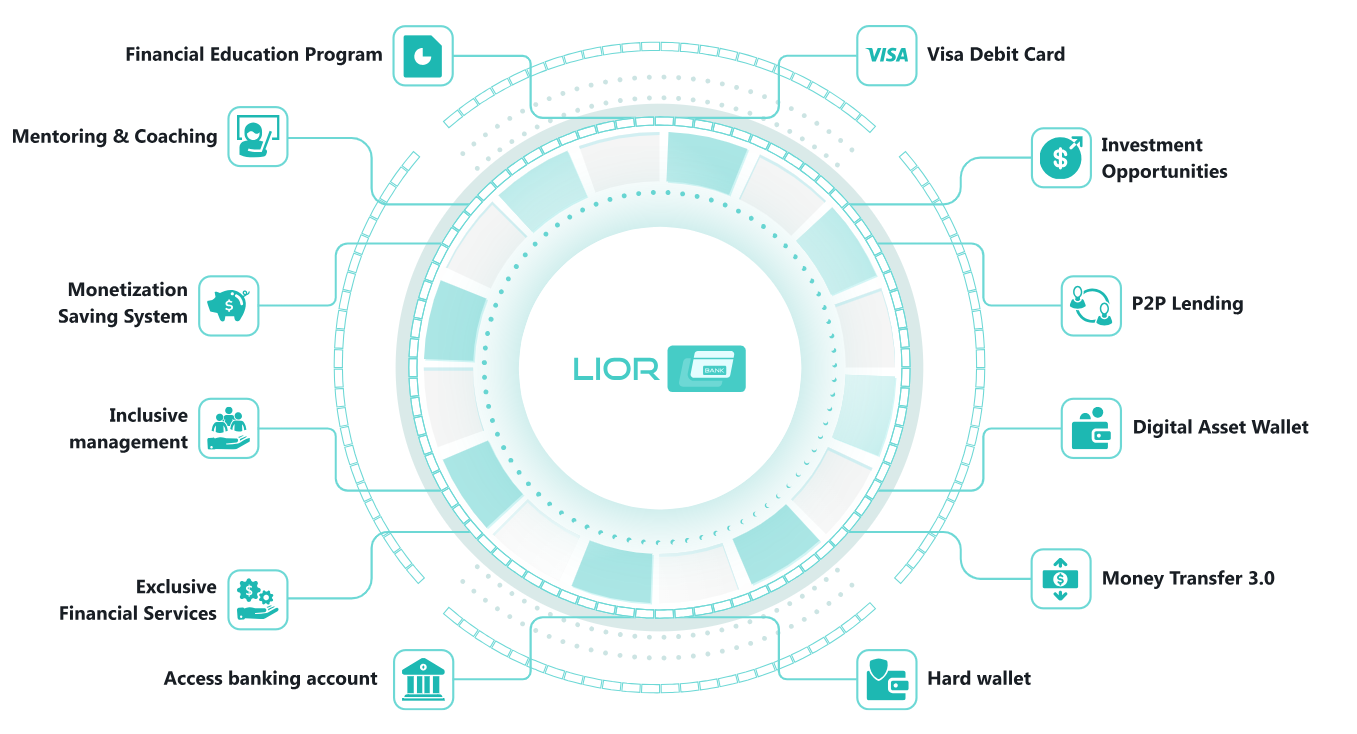

A viable payment token requires three fundamental characteristics: liquidity, price stability, and transactional confidence. The February 3-10 performance window demonstrates LIORS’s progression across all three dimensions.

The 158% surge in trading volume indicates deepening liquidity pools, which is essential for payment functionality. According to Medium’s analysis of novel utility token use cases in 2026, “properly designed utility tokens aim at long-term utility rather than unrealistic offers, creating confidence among users who prefer stability and certainty to speculation.”

The minimal price movement despite volume surges suggests that LIORS is developing the stability characteristics necessary for medium-of-exchange functions. The compression of volatility from €0.47 to €0.07 intraday range represents the kind of predictability that corporate treasuries and payment processors require.

The bid/ask ratio remaining above 1.0 (declining slightly from 1.55 to 1.43) indicates sustained buy-side dominance while also showing increased sell-side participation. This balance is crucial for payment tokens, which require both ready buyers (for merchants converting to fiat) and sellers (for users acquiring tokens for payments).

The use of digital assets as collateral represents one of the most significant institutional adoption trends in 2026. As K&L Gates noted in their analysis of crypto democratization, “commercial law clarity will accelerate the use of digital assets as collateral, with amendments to the Uniform Commercial Code taking effect across U.S. states providing greater clarity around security interests in digital asset collateral.”

📊 $30 billion in 2026 - Tokenized RWA Market Size

For an asset to function as effective collateral, it must demonstrate:

- Predictable Valuation: The tightening price ranges indicate reduced downside dispersion, improving risk-adjusted collateral valuation

- Liquidity for Liquidation: Increased volume ensures that collateral can be liquidated efficiently if needed

- Regulatory Compliance: LCX’s registration with Liechtenstein’s Financial Market Authority provides the regulatory framework necessary for institutional collateral acceptance

The narrowing volatility profile is particularly significant for lenders and structured finance mechanisms. According to Sidley’s 2026 blockchain outlook, “assets that generate predictable revenues but suffer from fragmented or illiquid secondary markets are well suited to tokenization, with institutions selectively incorporating tokenized assets to improve collateral mobility.”

“Tokenized RWAs increasingly sit inside familiar legal and financial structures to improve collateral mobility, fractional participation, and settlement efficiency” — Sidley LLP

The growth in active orders and depth of the order book during the analysis period suggests a broader and more distributed holder base—a critical characteristic for legitimate governance functionality.

A governance token’s credibility depends on avoiding concentration risk. The increased order book depth indicates:

- More participants entering the market at various price levels

- Reduced likelihood of governance capture by large holders

- Growing stakeholder alignment with long-term protocol success

According to Bitrue’s analysis of top governance tokens in 2026, “governance tokens allow holders to vote on protocol upgrades, treasury usage, and DAO decisions, with developer activity remaining focused on improving capital efficiency and refining user experience.”

The transition from speculative trading to utility-driven valuation creates the foundation for meaningful governance participation. As Medium’s governance token analysis notes, “governance tokens in 2026 are becoming accompanied by delegated voting mechanisms, reputation-weighted participation, and time-locked voting that promote rational decision-making and long-term alignment.”

LiorS’s design includes participation token characteristics that align holder interests with ecosystem growth—similar to equity ownership structures but implemented through blockchain infrastructure.

The ability of LIORS to handle a tripling of volume while maintaining price stability demonstrates institutional-grade resilience consistent with:

- Tokenized capital contributions

- Performance-linked economic rights

- Long-term ecosystem alignment mechanisms

According to Coinbase’s 2026 crypto market outlook, “protocols are leaning into value capture—fee-sharing, buybacks, buy-and-burn—as policy clarity enables linking tokenholder economics to platform usage, representing an emerging shift toward durable, revenue-tied models.”

“Tokenomics 2.0 protocols are leaning into value capture as policy clarity enables linking tokenholder economics to platform-usage” — Coinbase Institutional Research

Order book depth serves as a critical indicator of market health and institutional participation. According to Altrady’s liquidity analysis, “greater order book depth indicates many buy and sell orders across a range of prices, making the asset more stable and less susceptible to sudden swings.”

The LIORS order book demonstrated:

- Increasing depth: More orders at multiple price levels

- Balanced participation: Bid/ask ratio near 1.5 indicates healthy two-sided market

- Reduced spread: Tighter bid-ask spreads signal improved market efficiency

The 158% volume increase without corresponding price disruption suggests professional market-making activity and institutional accumulation patterns. As FalconX’s orderbook dynamics research notes, “a bid-ask skew ratio above one indicates greater buy-side liquidity relative to sell-side, suggesting more latent demand.”

| Period | Volatility Characteristic | Market Interpretation |

| Early February | High intraday range (€0.47) | Price discovery phase |

| Mid-February | Compressed range (€0.07) | Consolidation phase |

| Trend | 85% volatility reduction | Maturation signal |

To contextualize LIORS’s performance, it’s valuable to compare against broader crypto market trends in February 2026.

According to CryptoRank’s January 2026 market recap, “the crypto market experienced a significant decline in January 2026, driven by macroeconomic uncertainty and overheated valuations, with the market no longer defined only by speculative trading but increasingly shaped by regulated investment products and stablecoin settlement infrastructure.”

📊 1-2% of multi-asset portfolios becoming standard - Institutional Crypto Allocation

While major cryptocurrencies experienced volatility and consolidation in early 2026, LIORS demonstrated:

- Resilience: Maintained price stability during broader market uncertainty

- Growth: Volume increased counter to declining market participation elsewhere

- Maturation: Volatility compression while other assets remained volatile

YouHodler’s cryptocurrency market analysis for 2026 notes that “institutional participation is expected to remain a major factor, with capital flows increasingly shaped by regulated investment products and long-term allocation strategies rather than short-term trading.”

This institutional focus aligns with LIORS’s performance characteristics, suggesting the token is attracting the type of sophisticated capital that values utility over speculation.

The February 3-10 performance window provides several signals for institutional allocators:

- Liquidity Adequacy: The 158% volume increase demonstrates sufficient market depth for institutional position building

- Volatility Management: The compressed price ranges indicate reduced tail risk

- Regulatory Framework: LCX’s Liechtenstein regulatory status provides institutional-grade compliance infrastructure

- Use Case Validation: The stability-amid-volume pattern validates utility-driven demand

Companies considering LIORS for treasury management or operational use should note:

- Payment Viability: Price stability supports medium-of-exchange functions

- Collateral Eligibility: Reduced volatility improves collateral haircut calculations

- Liquidity Access: Increased volume ensures treasury positions can be adjusted efficiently

The transition from “watched token” to “used token” creates opportunities for:

- Developers: Building applications leveraging LIORS payment rails

- Service Providers: Integrating LIORS for settlement and treasury operations

- Governance Participants: Engaging in protocol decision-making with reduced speculation noise

According to Grayscale’s 2026 digital asset outlook, “the tokens seeing institutional adoption are likely to be those with a clear use case, sustainable revenue, and access to regulated trading venues and applications.”

“Tokens seeing institutional adoption are those with clear use cases, sustainable revenue, and regulated trading venues” — Grayscale Research

LIORS’s performance demonstrates progress across all three dimensions, positioning it favorably for continued institutional adoption.

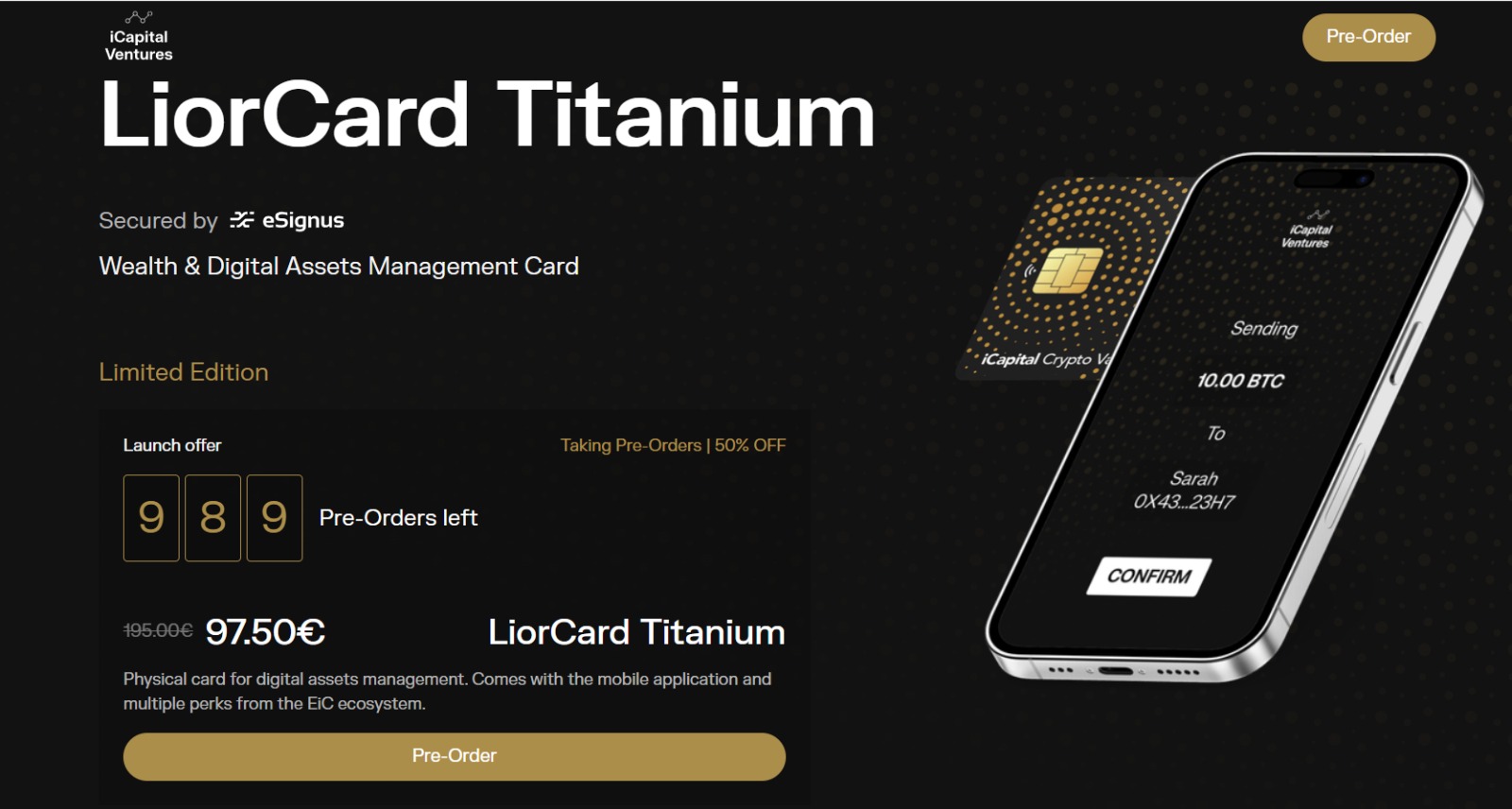

LiorS distinguishes itself through multi-functional utility spanning payment, collateral, governance, and participation use cases. Unlike single-purpose tokens, LIORS is designed to serve multiple roles within the iCapital Ventures/EIC Corporation ecosystem, creating diverse demand sources that support price stability. The token’s listing on LCX, a regulated Liechtenstein exchange, also provides institutional-grade compliance infrastructure that many utility tokens lack.

This pattern indicates that LIORS is being valued for utility rather than speculation. Increased volume with stable prices suggests: (1) growing adoption for actual use cases rather than trading, (2) deeper liquidity that reduces slippage for larger transactions, (3) reduced volatility risk for holders using LIORS for payments or collateral, and (4) a maturing market structure that attracts institutional participants who require predictability.

Yes, LIORS is designed to function as collateral for corporate financing within the iCapital ecosystem. The token’s improving stability profile, regulatory compliance through LCX, and increasing liquidity make it increasingly suitable for collateral applications. The narrowing volatility ranges observed in February 2026 improve risk-adjusted collateral valuations, making LIORS more attractive to lenders and structured finance mechanisms.

LIORS holders can participate in governance decisions affecting protocol upgrades, treasury allocations, risk parameters, and ecosystem grants. The growing distribution of token holders (evidenced by increased order book depth) supports more legitimate and decentralized governance. This aligns with 2026 trends toward governance tokens with delegated voting mechanisms and reputation-weighted participation that promote rational long-term decision-making.

While Bitcoin primarily serves as a store of value and Ethereum as a smart contract platform, LIORS is purpose-built for specific utility functions within the iCapital ecosystem. Rather than competing with major cryptocurrencies, LIORS addresses different use cases: corporate payments, collateralized financing, governance participation, and value accrual tied to ecosystem growth. The token’s stability-focused design contrasts with the higher volatility typical of major cryptocurrencies.

📊 +158% trading volume increase in one week while maintaining price stability (Source: LCX Exchange Data, February 2026)

💎 €2.70 average price maintained despite tripling of trading volume, demonstrating institutional-grade stability (Source: LCX Market Data)

📉 85% reduction in intraday volatility range, from €0.47 to €0.07, signaling market maturation (Source: LCX Trading Statistics)

🏦 $30 billion tokenized real-world asset market size in 2026, providing context for institutional tokenization trends (Source: a16z State of Crypto 2025)

The performance of LiorS (LIORS) between February 3 and 10, 2026, represents a significant milestone in the token’s evolution from a tradable digital asset to a functional utility instrument with genuine institutional relevance. The convergence of sharply higher volumes, declining volatility, deeper order books, and balanced market pressure indicates that LIORS is increasingly priced on utility rather than speculation.

This consolidation phase strengthens the strategic legitimacy of LiorS across its four primary use cases: as a payment infrastructure token enabling efficient transactions, as a corporate financing collateral asset with improving risk characteristics, as a governance mechanism supported by growing stakeholder distribution, and as a participation instrument that aligns holder interests with ecosystem value creation.

The market behavior observed during this period aligns with broader 2026 trends toward institutional consolidation, regulatory clarity, and utility-driven tokenomics. As noted by multiple institutional research sources, the crypto market is transitioning from narrative-driven speculation to fundamental value assessment based on real economic utility.

For LIORS, this transition is clearly underway. The market is beginning to price the token’s real economic utility, establishing a solid foundation for the next stages of adoption, structuring, and institutional integration. As regulatory frameworks continue to clarify, liquidity deepens, and use cases expand, LIORS appears well-positioned to capitalize on the institutional adoption wave reshaping digital asset markets in 2026 and beyond.

The key question for market participants is no longer whether LIORS can function as a multi-purpose utility token—the February 3-10 performance window provides compelling evidence that it can. The question now is how rapidly adoption will scale as institutional participants increasingly recognize the value of stability, regulatory compliance, and genuine utility in their digital asset allocations.

Share

00 Comments

No Comments found!