March 21, 2025, marks a decisive milestone in the startup and SME financing sector with the signing of a Memorandum of Understanding (MOU) between iCapital Ventures, a subsidiary of EiC Corporation (France), and Enlighten Capital (formerly Enlighten Angel Fund). This strategic agreement aims to establish an investment fund in Gift City, facilitate the expansion of Indian startups into international markets, and develop an innovative fintech platform for the Indian market. This collaboration is based on a shared vision: structuring and financing innovative companies while optimizing their access to capital.

iCapital Ventures: A Leading Fintech Player

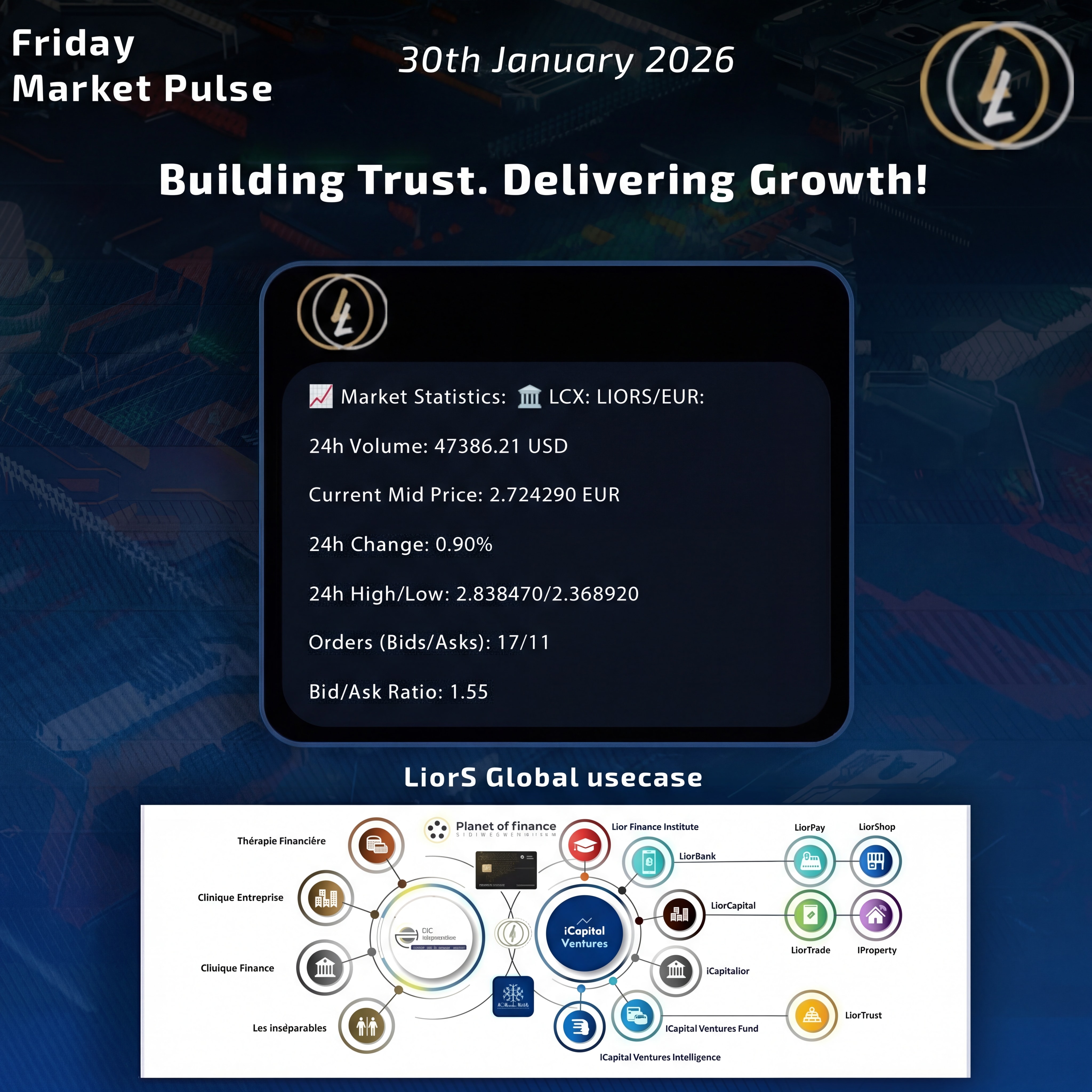

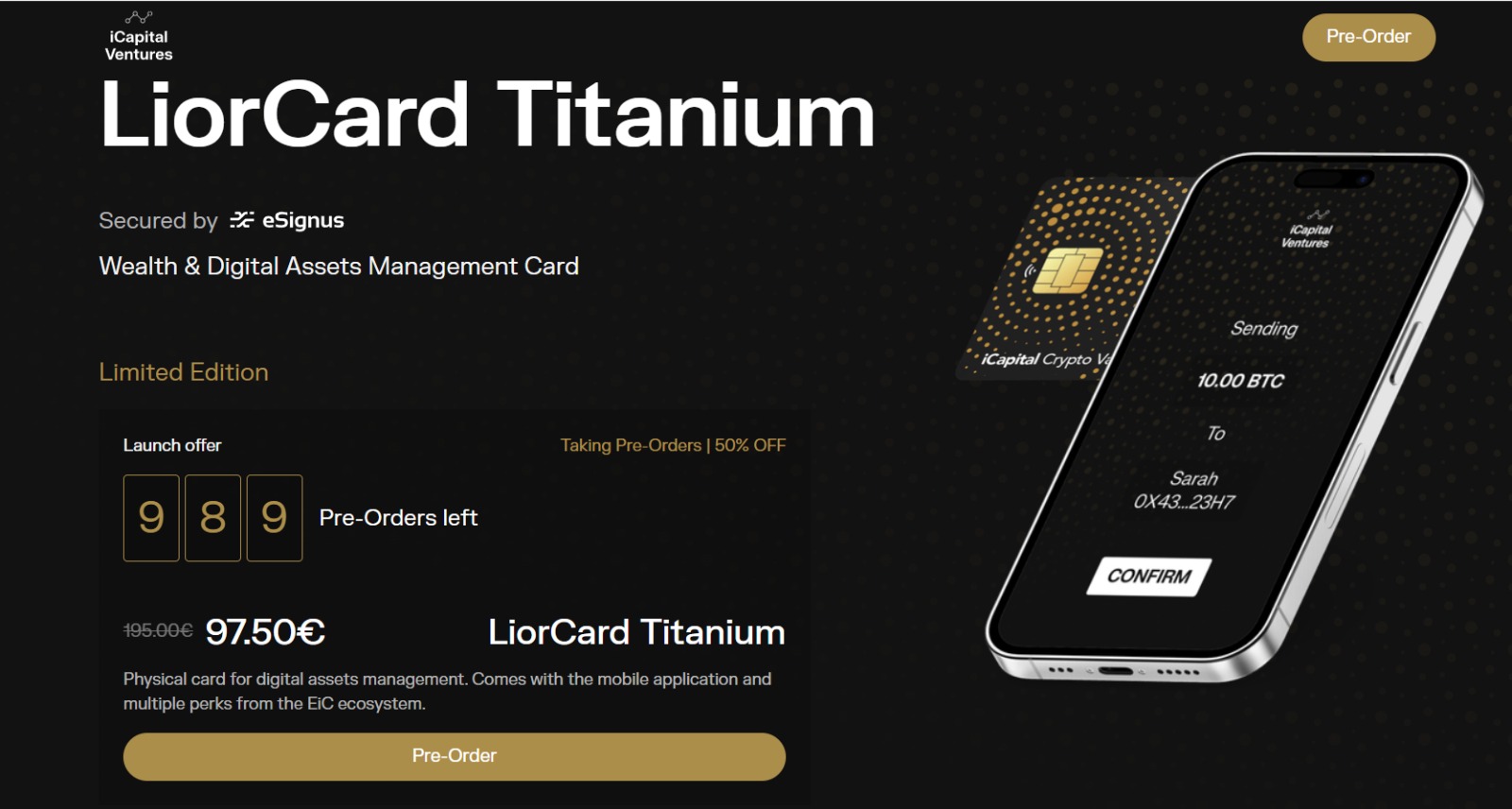

Founded under the aegis of EiC Corporation, iCapital Ventures positions itself as a pioneer in SME financial structuring, liquidity mobilization, and business valuation. Through its integrated financial rating system, iCapital Ventures provides next-generation financing solutions to a vast community of entrepreneurs. The company, which plans to go public in 2028, already boasts an impressive portfolio with:

- 6,000 members and 10,000 beneficiaries

- 7 think tanks and 2 dedicated tokens

- 350 employees and over €20 million deployed

This expertise allows iCapital Ventures to play a key role in facilitating SME financing and growth, ensuring transparency and capital optimization.

Enlighten Capital: An Investment Vision Focused on Innovation

Enlighten Capital, registered with SEBI as an Alternative Investment Fund (AIF), specializes in startups in emerging technologies, smart manufacturing, and fintech. The firm is committed to supporting early-revenue startups, focusing on business models that have found their product-market fit.

Enlighten Capital's approach is based on three fundamental pillars:

- Strategic guidance to ensure sustainable growth

- Capital access for high-potential startups

- Sectoral expertise in disruptive technologies

Through this vision, Enlighten Capital has established itself as a key player in innovation financing in India.

A Partnership with Ambitious Objectives

The partnership between iCapital Ventures and Enlighten Capital is based on three major pillars:

Creation of an Investment Fund in Gift City

This fund will mobilize capital to support the startup and SME ecosystem in India and globally.

The goal is to structure an efficient investment vehicle, optimizing profitability while minimizing risks for investors.

Facilitation of Indian Startups' International Expansion

With its expertise and international network, iCapital Ventures will provide Indian startups with privileged access to European, African, and Asian markets.

Enlighten Capital will offer strategic mentorship and operational support to optimize successful fundraising and expansion abroad.

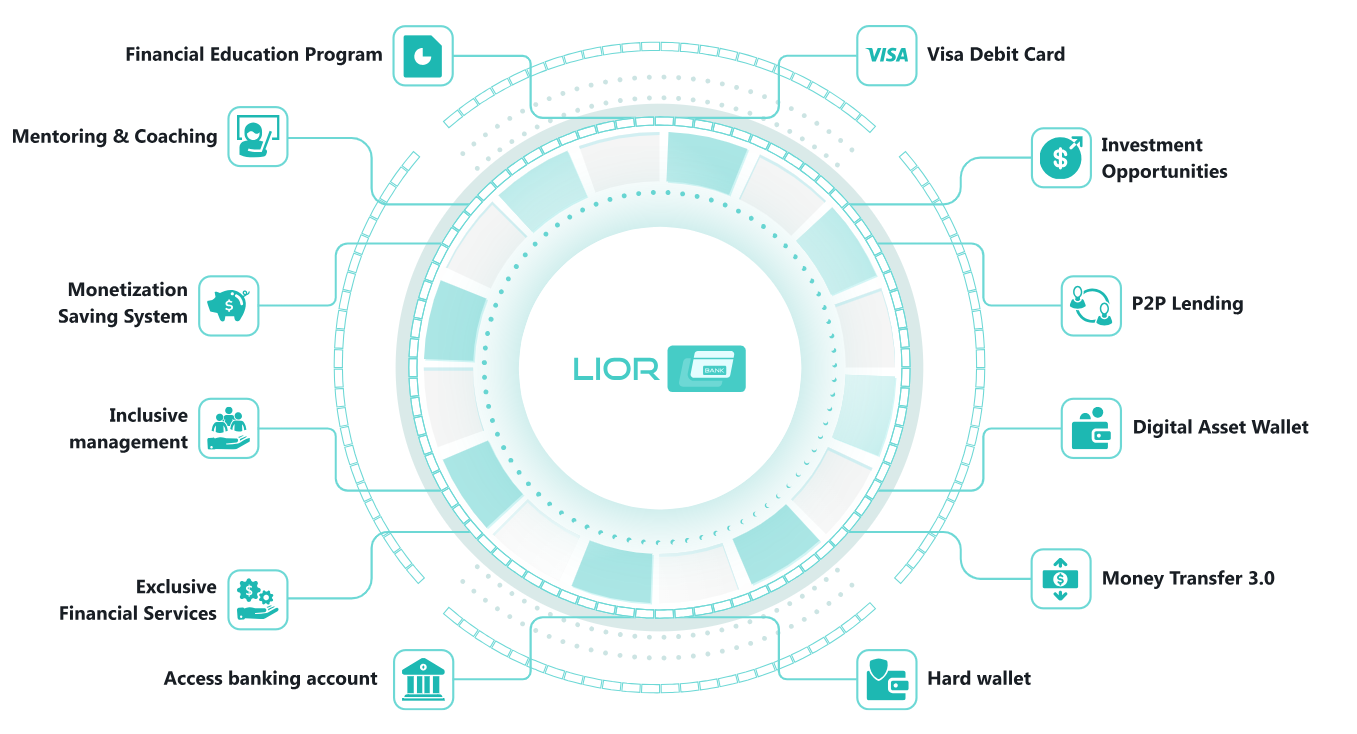

Development of an Innovative Fintech Platform for India

This platform will be designed to meet the specific needs of Indian businesses in terms of financing, liquidity management, and financial structuring.

It will integrate cutting-edge technologies, such as artificial intelligence and blockchain, to optimize financing and business evaluation processes.

Perspectives and Challenges

This partnership represents a significant advancement for the Indian and global entrepreneurial ecosystem. By combining iCapital Ventures’ financial and technological expertise with Enlighten Capital’s investment knowledge in startups, this collaboration could:

- Accelerate the growth of Indian startups by providing them with financing and international expansion opportunities.

- Strengthen Gift City's role as a financial and technological hub for startups and SMEs.

- Create a ripple effect by encouraging other institutional investors and venture capital funds to engage in similar projects.

- Facilitate the adoption of new technologies in the Indian financial sector, particularly through the introduction of blockchain and AI-based solutions.

The agreement signed between iCapital Ventures and Enlighten Capital paves the way for a profound transformation in startup and SME financing. By pooling their resources and expertise, these two entities aim to provide innovative financing solutions, accelerate business internationalization, and strengthen the Indian fintech ecosystem.

This partnership embodies a bold and ambitious vision for the future of investment in India and globally. It also reflects a dynamic of international collaboration, essential for fostering the economic and technological growth of 21st-century enterprises.

The road to 2028, with iCapital Ventures’ planned IPO, promises to be rich in opportunities and innovations. Entrepreneurs, investors, and financial market players now have a solid and strategic platform to shape the future of startup and SME financing.

Share

00 Comments

No Comments found!