The investment landscape is undergoing a profound transformation in 2026. As AI startups capture over 50% of all venture capital funding for the first time and digital platforms redefine how wealth is managed, a new breed of financial super apps is emerging to consolidate fragmented services into unified ecosystems. Enter iCapital Ventures Intelligence, a revolutionary platform that brings private equity, wealth management, governance, education, and fundraising into one powerful, intuitive digital cockpit.

iCapital Ventures Intelligence represents the evolution of financial services into a comprehensive super app for finance and investment. Rather than juggling multiple platforms, apps, and portals for different investment activities, users access the entire iCapital Ventures ecosystem through a single, seamlessly integrated interface available on web, iOS, and Android.

📊 Expected to use super apps by 2027 - 50% of global population

This unified approach addresses a critical pain point in modern investing: fragmentation. Traditional investment management requires navigating separate platforms for private equity deals, wealth tracking, governance oversight, educational resources, and fundraising activities. iCapital Ventures Intelligence consolidates these functions into one digital cockpit, dramatically improving efficiency and user experience.

“Super apps combine messaging, payments, commerce, mobility, and lifestyle services into one platform with single sign-on, unified wallets, and mini-app marketplaces” — Tech Times Digital Ecosystem Report

The financial technology landscape in 2026 is characterized by convergence. Digital-only banks have evolved beyond simple account management into comprehensive “super-apps” offering insurance, crypto trading, investment management, and lifestyle services. The global neobank market is projected to reach $2.3 trillion by 2030, with the most successful platforms distinguished by their ability to offer integrated, multi-service experiences.

Several factors are accelerating super app adoption in finance:

| Factor | Impact | Example |

| Unified Wallet Adoption | Single payment layer connects all services | Instant transfers between investment accounts |

| AI Assistant Integration | Personalized recommendations across services | Smart portfolio rebalancing suggestions |

| Cross-App Friction Reduction | Seamless user experience | One login for all financial activities |

| Lower Acquisition Costs | Retain users within ecosystem | Higher lifetime value per customer |

| Regulatory Clarity | Institutional frameworks emerging | MiCA in Europe, updated accreditation rules |

📊 Have embedded AI in daily operations - 70% of global banks

WealthTech platforms are now democratizing sophisticated investment strategies previously reserved for ultra-high-net-worth individuals. Robo-advisors are expected to manage over $3.2 trillion globally by 2026, while platforms offering direct access to private markets are experiencing exponential growth.

iCapital Ventures Intelligence brings together multiple critical functions that previously required separate platforms:

- Private Equity Access: Direct participation in PE deals and club investments

- Portfolio Tracking: Real-time performance monitoring with advanced analytics

- Smart Investing: AI-powered insights and recommendations

- Unified Dashboard: Complete view of all assets and investments

- Performance Metrics: Detailed ROI, IRR, and benchmark comparisons

- Risk Assessment: Automated portfolio risk analysis

- Governance Dashboards: Full visibility into fund operations and decisions

- Voting Rights: Participate in key investment decisions

- Compliance Tracking: Real-time regulatory compliance status

- Investment Education: Curated content for different accreditation levels

- Market Insights: Expert analysis and trend reports

- Webinars & Training: Live and on-demand educational sessions

- Deal Flow Access: Exclusive investment opportunities

- Syndication Tools: Co-invest with other qualified investors

- Capital Raising: Platform for fundraising activities

Accreditation Levels: Your Gateway to Premium Services

One of iCapital Ventures Intelligence’s most innovative features is its tiered accreditation system, which grants access to services based on investor qualification levels. This approach aligns with evolving regulatory frameworks while ensuring appropriate investor protection.

As of 2026, accredited investor definitions continue to expand beyond traditional wealth thresholds. While the core requirements remain—$200,000 annual income ($300,000 joint) or $1 million net worth (excluding primary residence)—new pathways include professional credentials and demonstrated financial sophistication.

“Investment professionals holding Series 7, Series 65, or Series 82 licenses in good standing qualify as accredited investors” — SEC Investor Resources

| Tier | Requirements | Services Unlocked |

| Silver | Basic accredited investor status | LiorLink, LiorCard, basic portfolio tracking |

| Gold | Enhanced net worth or income verification | LiorBank, LFI, advanced analytics |

| Diamond | Qualified purchaser status ($5M+ investments) | LiorCapital, iCapitalior, exclusive deals |

| NED | Non-Executive Director qualification | Governance dashboards, voting rights |

| QISR | Qualified Institutional Sophisticated Investor | Full platform access, LiorTrade, iProperty, LiorTrust, iCV Participations |

This tiered approach ensures that investors access opportunities appropriate to their sophistication level while maintaining regulatory compliance—a critical consideration as global regulators explore democratizing private markets.

📊 AI startup VC funding in 2025, representing 34% of all VC - $89.4 billion

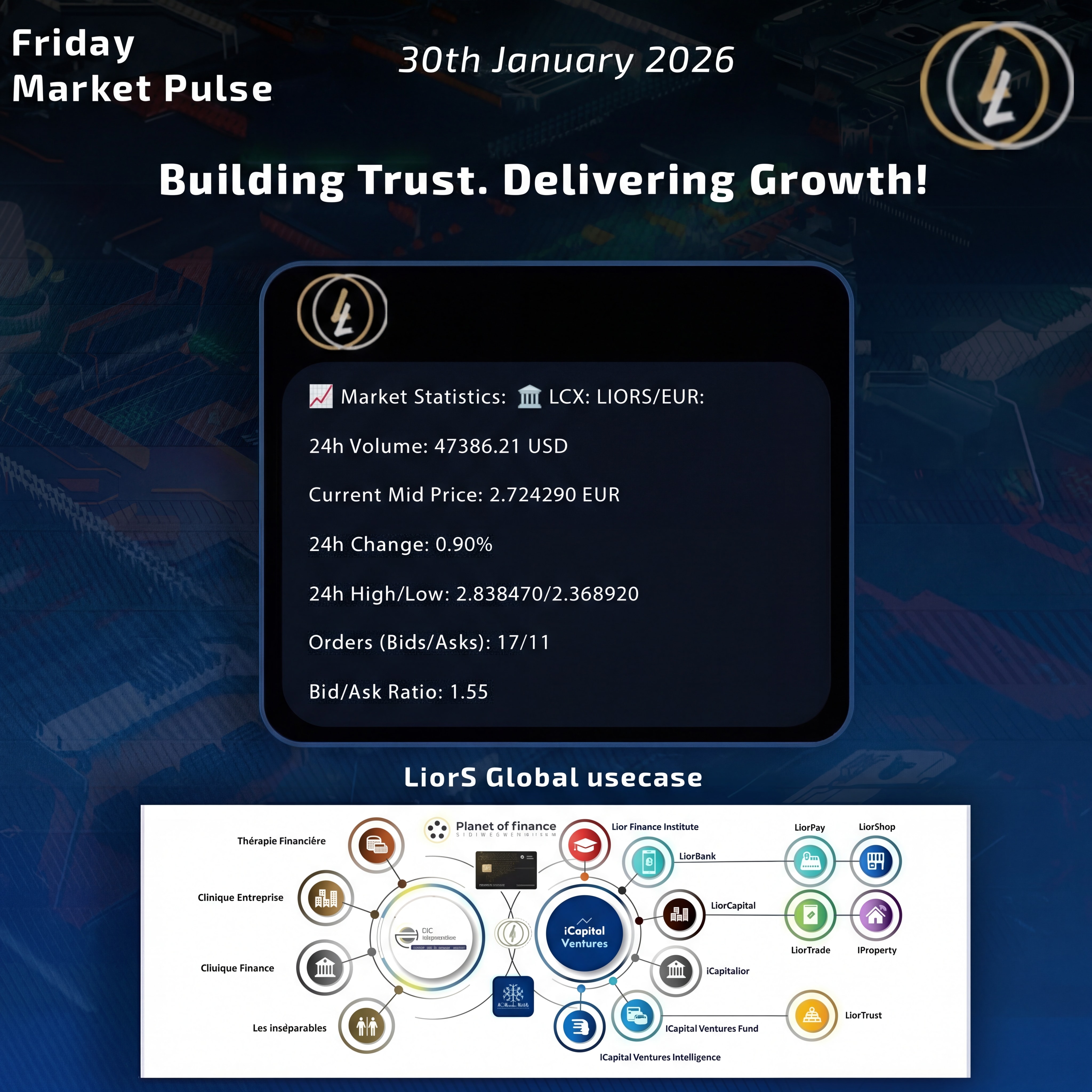

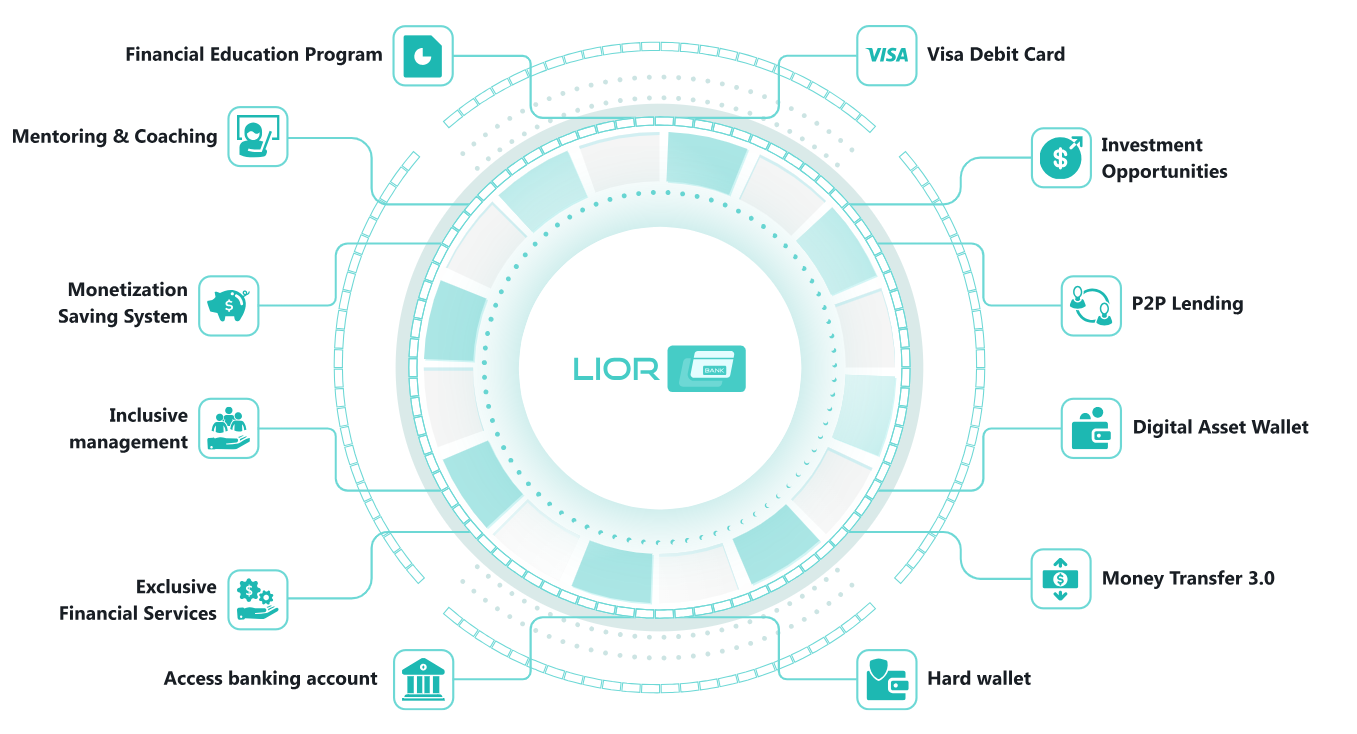

The true power of iCapital Ventures Intelligence lies in its interconnected service ecosystem. Each component is designed to work seamlessly with others:

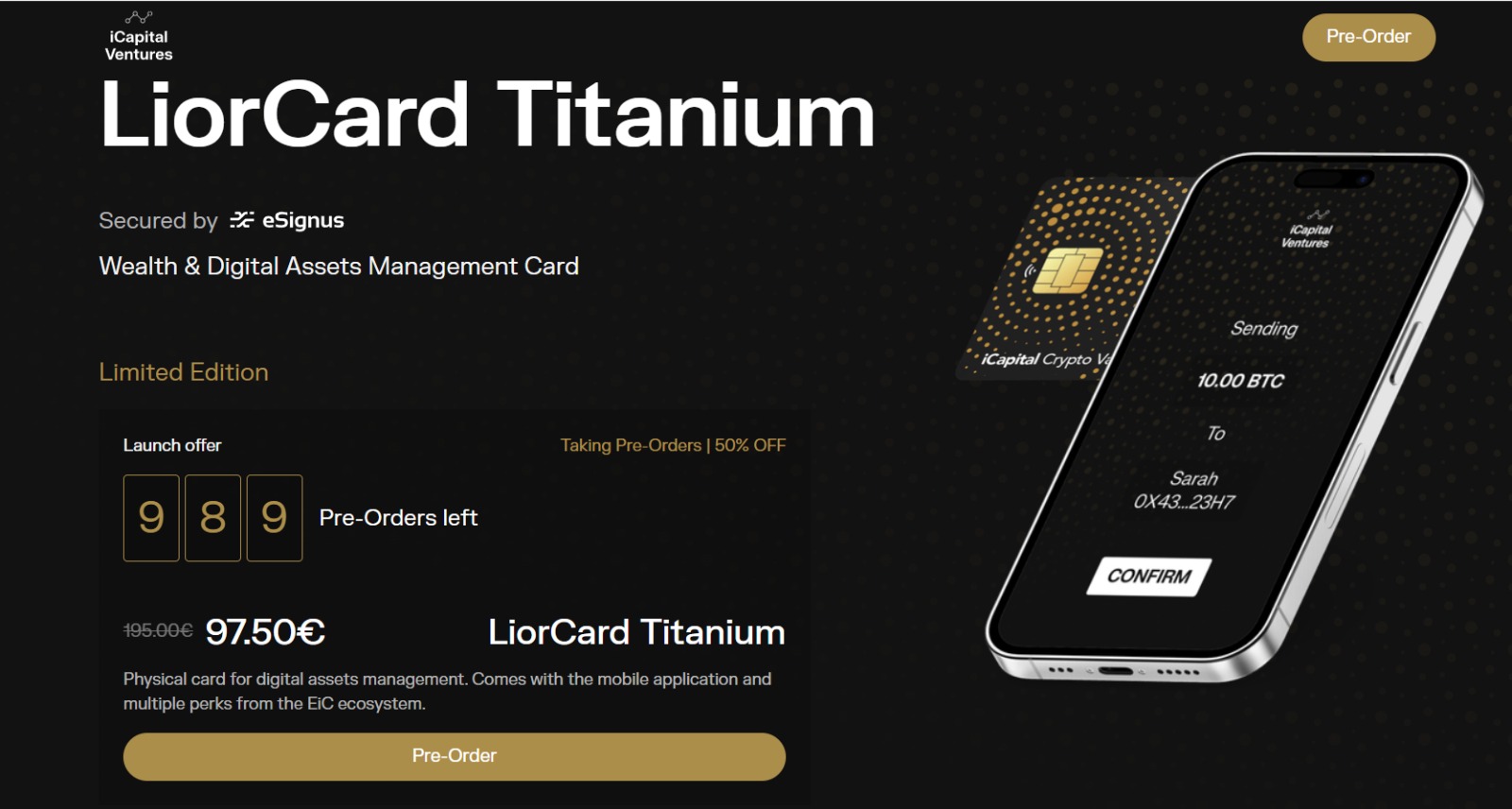

- LiorLink: Connecting investors with opportunities

- LiorCard: Integrated payment and rewards system

- LiorBank: Digital banking services for investment management

- LFI: Structured financial instruments

- LiorCapital: Private equity and venture capital investments

- iCapitalior: Alternative investment access

- LiorTrade: Trading platform for liquid securities

- iProperty: Real estate investment opportunities

- LiorTrust: Fiduciary services and trust management

- iCV Participations: Direct participation in portfolio companies

This integration creates powerful network effects. For example, rewards earned through LiorCard can be automatically invested through LiorCapital, while performance data from all platforms feeds into unified analytics dashboards accessible via any device.

The shift toward super apps in financial services isn’t merely a technological trend—it represents a fundamental reimagining of how investors interact with their wealth.

Traditional wealth management requires maintaining relationships with multiple institutions: a private equity fund, a wealth advisor, a trading platform, a bank, and various specialized service providers. Each has its own login, interface, reporting format, and fee structure. iCapital Ventures Intelligence eliminates this fragmentation.

📊 Will interact primarily with digital-first financial products in 2026 - 80% of global consumers

By consolidating activities into one platform, iCapital Ventures Intelligence gains comprehensive insight into investor behavior, preferences, and goals. This enables hyper-personalization previously available only to ultra-high-net-worth clients working with dedicated advisors.

Research consistently shows that reducing friction in user experiences dramatically increases engagement. When investors can move seamlessly from reviewing performance to accessing educational content to participating in a new deal—all within minutes and without switching platforms—they engage more frequently and make more informed decisions.

| Aspect | Traditional Approach | iCapital Ventures Intelligence |

| Platform Count | 5-10 separate services | Single unified platform |

| Login Process | Multiple credentials | One-time authentication |

| Data Integration | Manual consolidation required | Automatic aggregation |

| Fee Transparency | Fragmented across providers | Unified fee structure |

| Mobile Experience | Limited or inconsistent | Full-featured native apps |

| Support | Multiple contact points | Centralized support team |

One of the most compelling features of iCapital Ventures Intelligence is its commitment to transparency—a critical differentiator in an industry often criticized for opacity.

Unlike traditional private equity investments where performance updates arrive quarterly via PDF reports, iCapital Ventures Intelligence provides real-time access to:

- Current valuations across all holdings

- Cash flow tracking (contributions and distributions)

- IRR calculations updated continuously

- Benchmark comparisons against relevant indices

- Tax reporting and documentation

For investors holding governance rights, the platform provides unprecedented visibility into fund operations:

- Upcoming voting items with detailed background

- Historical voting records and outcomes

- Direct communication channels with fund managers

- Document repositories with all fund materials

- Compliance status and regulatory filings

This level of transparency builds trust and enables more informed decision-making—particularly important as institutional investors increasingly prioritize ESG factors and operational excellence.

iCapital Ventures Intelligence arrives at a pivotal moment in financial services evolution. Several converging trends suggest that integrated super apps will become the dominant model for wealth management:

Artificial intelligence is moving beyond pilot programs to become the operational backbone of financial institutions. Over 70% of global banks have embedded AI in daily operations, yet fewer than 20% have achieved scalable automation. Platforms like iCapital Ventures Intelligence that integrate AI from the ground up gain significant competitive advantages in:

- Automated compliance monitoring

- Intelligent deal matching

- Predictive performance analytics

- Personalized education pathways

- Risk assessment and portfolio optimization

The trend toward “embedded wealth” means investment services are increasingly appearing where clients already spend time—in payroll platforms, e-commerce wallets, and corporate ecosystems. Super apps are uniquely positioned to serve as both destination platforms and infrastructure providers, offering white-labeled services that can be integrated into partner ecosystems.

While iCapital Ventures Intelligence focuses on traditional and alternative assets, the broader trend toward tokenization of real-world assets is creating new opportunities. Platforms that can seamlessly integrate tokenized securities, real estate, and other assets into unified portfolios will capture significant market share as institutional adoption accelerates.

“Financial interactions such as payments, transfers, and balance checks generate high-quality data on spending patterns, income flows, and risk, making finance a solid foundation for ecosystem expansion” — Adjust Mobile App Analytics

While super apps have dominated in Asia, Africa, and Latin America for years, adoption in Western markets is accelerating. The United States and Canada are beginning super app consolidation around fintech, mobility, and communication—with platforms like iCapital Ventures Intelligence positioned to capture affluent investors seeking sophisticated, integrated solutions.

📊 $2.3 trillion - Projected global neobank market value by 2030 (LinkedIn FinTech Trends Analysis)

💡 34% - Share of all VC funding captured by AI startups in 2025, totaling $89.4 billion (Global Venture Capital Report)

🌐 50% - Percentage of global population expected to use super apps by 2027 (Gartner)

💰 $3.2 trillion - Assets under management by robo-advisors globally in 2026 (WealthTech Industry Report)

🏦 70% - Global banks that have embedded AI in daily operations (PwC Financial Services 2026)

📱 80% - Global consumers who will interact primarily with digital-first financial products in 2026 (FinTech Evolution Study)

iCapital Ventures Intelligence is a comprehensive super app that consolidates private equity, wealth management, governance, education, and fundraising into a single unified platform. Unlike traditional platforms that specialize in one area, it provides seamless integration across the entire investment lifecycle—from deal discovery to performance tracking to governance participation—all accessible via web, iOS, and Android with a single login.

The platform uses a tiered accreditation system (Silver, Gold, Diamond, NED, QISR) that determines which services you can access. After completing the accreditation process, you’ll unlock specific features based on your qualification level. Higher tiers provide access to more sophisticated investment opportunities, advanced governance tools, and exclusive deal flow. The system ensures compliance with regulatory requirements while matching investors with appropriate opportunities.

Security is paramount for iCapital Ventures Intelligence. The platform employs bank-grade encryption, multi-factor authentication, and distributed security architecture to protect user data. All financial transactions are processed through secure, regulated channels, and the platform maintains compliance with relevant financial regulations including data privacy requirements. Regular security audits and continuous monitoring ensure ongoing protection.

Yes, one of the platform’s core features is unified portfolio tracking. You can monitor performance across all your iCapital Ventures investments in real-time, including private equity positions, liquid securities, real estate holdings, and other alternative assets. The dashboard provides comprehensive analytics, benchmark comparisons, cash flow tracking, and tax reporting—all consolidated into a single view accessible from any device.

The platform includes a comprehensive education center with content tailored to different accreditation levels and investment experience. Resources include market insights, expert analysis, investment strategy guides, webinars, and interactive training modules. As you progress through different accreditation tiers, you gain access to more advanced educational content aligned with the sophisticated investment opportunities available at each level.

iCapital Ventures Intelligence represents the future of investment management—a future where fragmentation gives way to integration, opacity to transparency, and complexity to intuitive design. As financial services continue their digital transformation in 2026, super apps that successfully consolidate multiple functions into seamless, user-friendly experiences will capture disproportionate market share.

For investors navigating an increasingly complex landscape—where AI startups attract record funding, private markets democratize, and traditional boundaries between asset classes blur—having a unified digital cockpit isn’t just convenient. It’s essential.

Whether you’re an accredited investor seeking access to private equity deals, a sophisticated investor managing a diversified portfolio, or an institutional participant requiring governance visibility, iCapital Ventures Intelligence provides the infrastructure, transparency, and tools needed to invest smarter, faster, and with full confidence.

One app. One ecosystem. One future.

Ready to experience the next generation of investment management? Access iCapital Ventures Intelligence on Android, Web, or iOS.

Share

00 Comments

No Comments found!