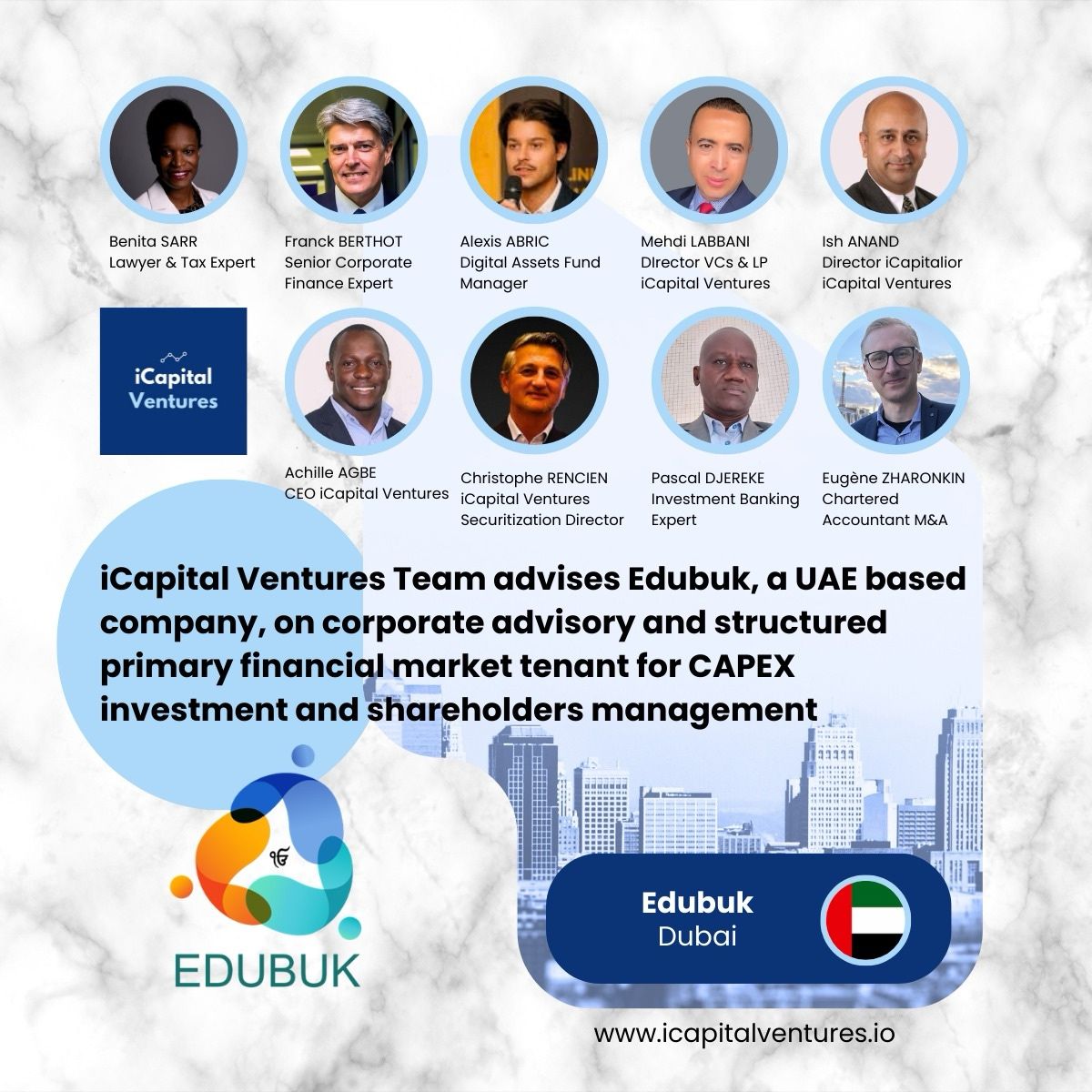

In a landmark move poised to reshape investment dynamics in the education technology sector, iCapital Ventures, has officially announced the launch of a primary market tenant for Edubuk’s Certified Emerging Technologies Analyst (CETA) Program. This initiative integrates a sophisticated investment deal room, enabling Edubuk to issue financial securities for its CAPEX fundraising efforts. By bridging structured finance with corporate governance, this platform offers an avant-garde solution to accelerate Edubuk’s expansion while ensuring transparency and investor confidence.

This strategic collaboration underscores iCapital Ventures’ commitment to financial engineering, legal and tax advisory, and investor relations, positioning Edubuk at the forefront of emerging technologies education financing.

A Synergistic Financial Ecosystem

1. Primary Market Tenant: Revolutionizing CAPEX Fundraising

The newly launched primary market tenant serves as a dedicated financial marketplace where Edubuk can issue equity, debt, or hybrid securities to institutional and private investors. Unlike traditional fundraising methods, this model enhances liquidity and accessibility, allowing Edubuk to:

- Secure growth capital efficiently.

- Diversify its investor base through regulated securities offerings.

- Maintain optimal corporate governance with structured shareholder frameworks.

2. Investment Deal Room: Facilitating Strategic Partnerships

Complementing the primary market, the investment deal room functions as a dynamic negotiation hub where stakeholders can evaluate Edubuk’s financial prospects. Key features include:

- Real-time deal structuring for tailored investment opportunities.

- Enhanced due diligence through integrated legal and tax advisory.

- Investor matchmaking, connecting Edubuk with high-net-worth individuals (HNWIs) and venture capitalists.

3. Strategic Advisory: The iCapital Advantage

iCapital Ventures provides Edubuk with end-to-end expertise in:

- Financial Engineering: Structuring capital raises to minimize risk and maximize returns.

- Legal & Tax Optimization: Ensuring compliance with UAE and international regulations.

- Financing Structure Enhancement: Balancing debt-to-equity ratios for sustainable growth.

- Investor Outreach: Leveraging iCapital’s global network to attract strategic backers.

Perspective: The Future of EdTech Financing

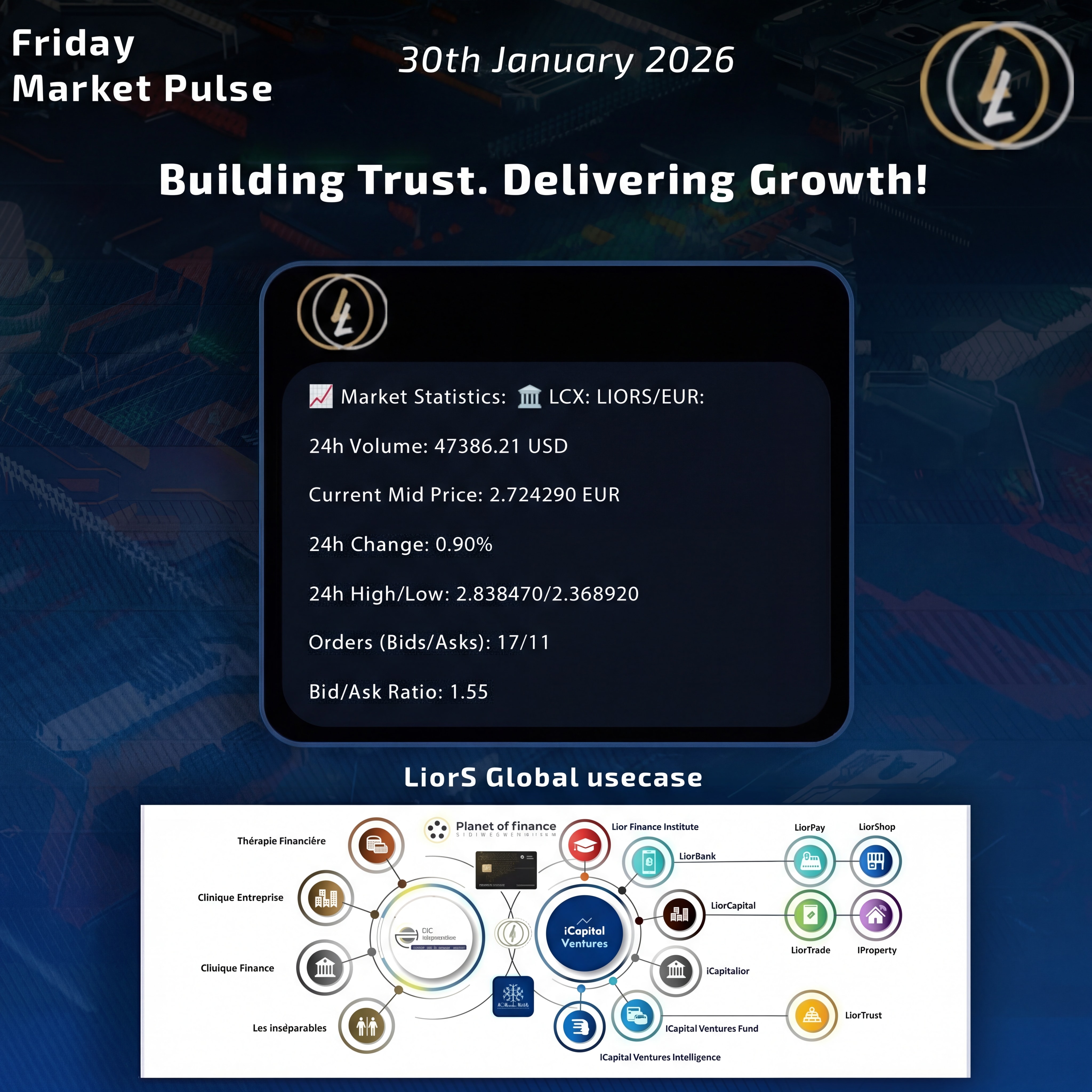

This initiative sets a precedent for EdTech financing, demonstrating how alternative capital markets can drive sectoral growth. As digital education demand surges, Edubuk’s CETA Program—backed by iCapital’s financial infrastructure—could inspire similar models worldwide.

Future developments may include:

- Blockchain-based securities for enhanced transparency.

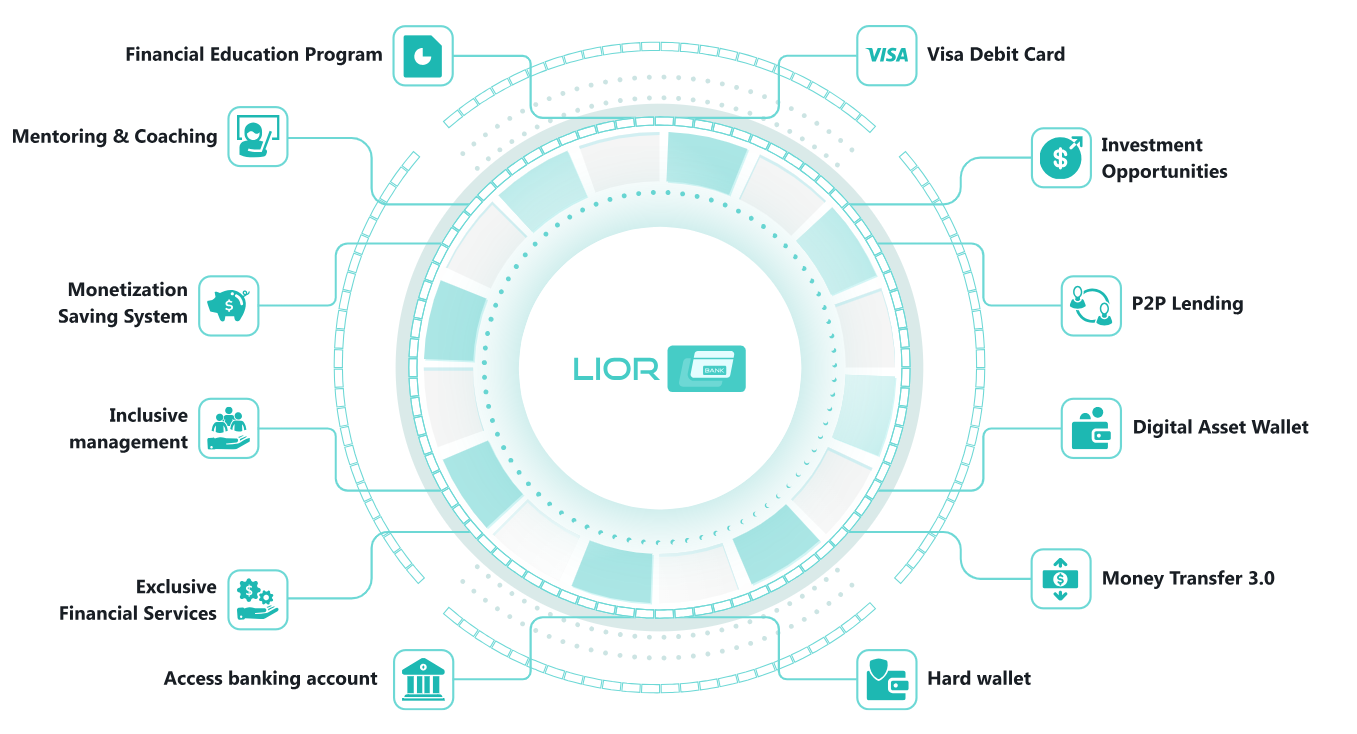

- AI-driven investor analytics to optimize fundraising strategies.

- Cross-border syndication to attract global institutional investors.

The collaboration between iCapital Ventures and Edubuk marks a transformative step in financial innovation, merging primary market efficiency with strategic investment facilitation. By deploying cutting-edge financial engineering and governance frameworks, this initiative not only fuels Edubuk’s expansion but also reinforces the UAE’s position as a hub for structured finance and EdTech advancement.

As the partnership evolves, it will likely catalyze broader adoption of alternative fundraising mechanisms, setting new benchmarks for investment banking, corporate governance, and financial technology. Together, iCapital Ventures and Edubuk are not just shaping the future of investment—they are redefining it.

Share

00 Comments

No Comments found!