A New Gateway for Institutional & Private Investors into Decentralized Investment Banking

After nearly 18 years of building a resilient and integrated financial ecosystem within EIC Corporation, we are proud to announce a decisive milestone in the evolution of our group: the official launch of the iCapital Ventures Participation (iCV Participation), our new Luxembourg-based investment vehicle designed to accelerate our global expansion and support high-growth SMEs.

1. A Strategic Milestone in the EIC Group’s Evolution

The creation of the iCV Participation marks the consolidation of our long-term vision: structuring a financial architecture capable of aligning governance, capital efficiency, and scalable investment strategies.

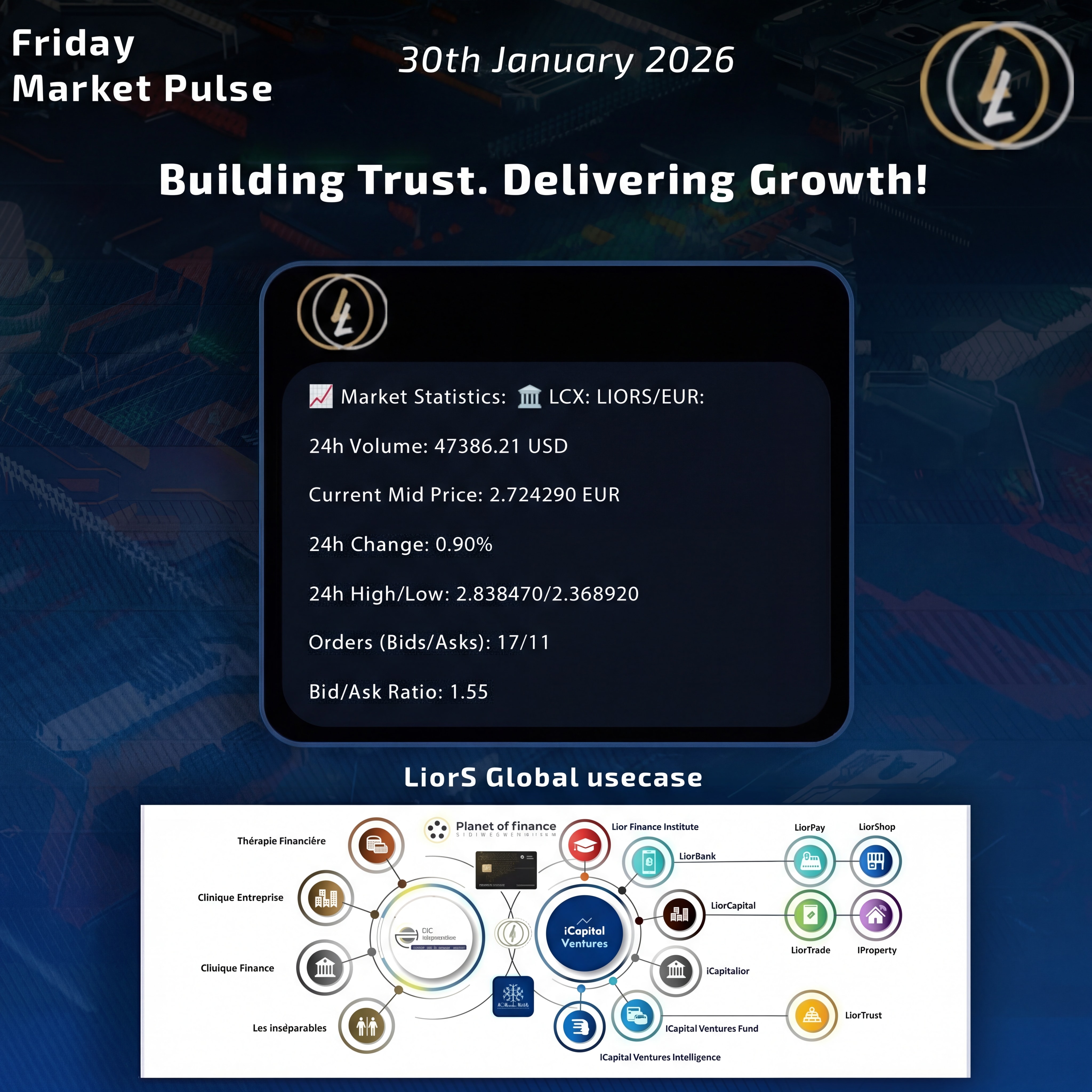

This vehicle represents the financial backbone of our DDFM – Financial & Managerial Development Framework, a model engineered to secure and accelerate:

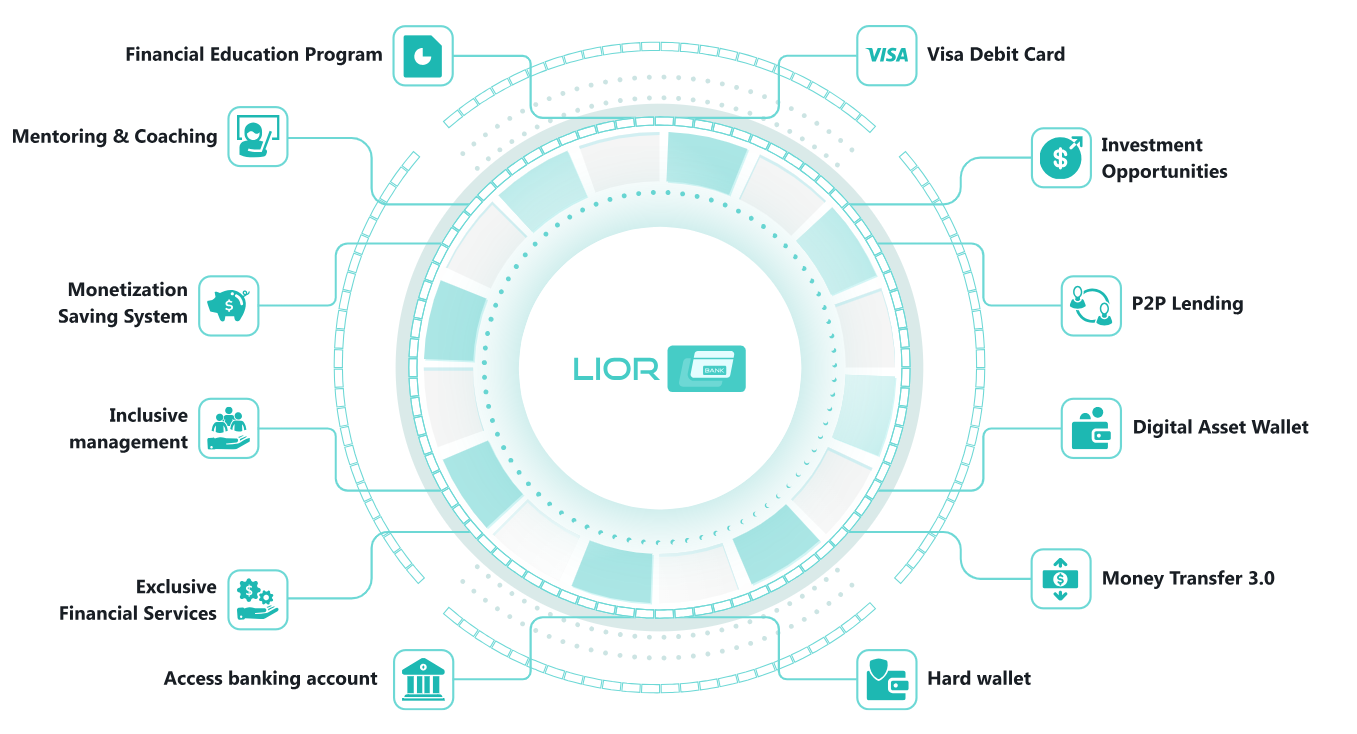

• OPEX financing through

• Liorbank (OPEX+)

• iCapitalior (OPEX++)

• CAPEX financing via Liorcapital

• Governance & 360° rating systems through Liorlink

By centralizing these mechanisms into a single, coherent and high-performance investment structure, the iCV Participation enhances capital allocation efficiency and strengthens our capacity to scale internationally.

2. A Hybrid Investment Fund at the Intersection of Two Financial Worlds

The iCV Participation is built as an innovative hybrid investment model, combining the robustness of traditional financial markets with the agility and transparency of digital finance.

The Participating fund integrates four strategic pillars:

✔ Institutional Financing

Mobilizing long-term capital with strong governance requirements.

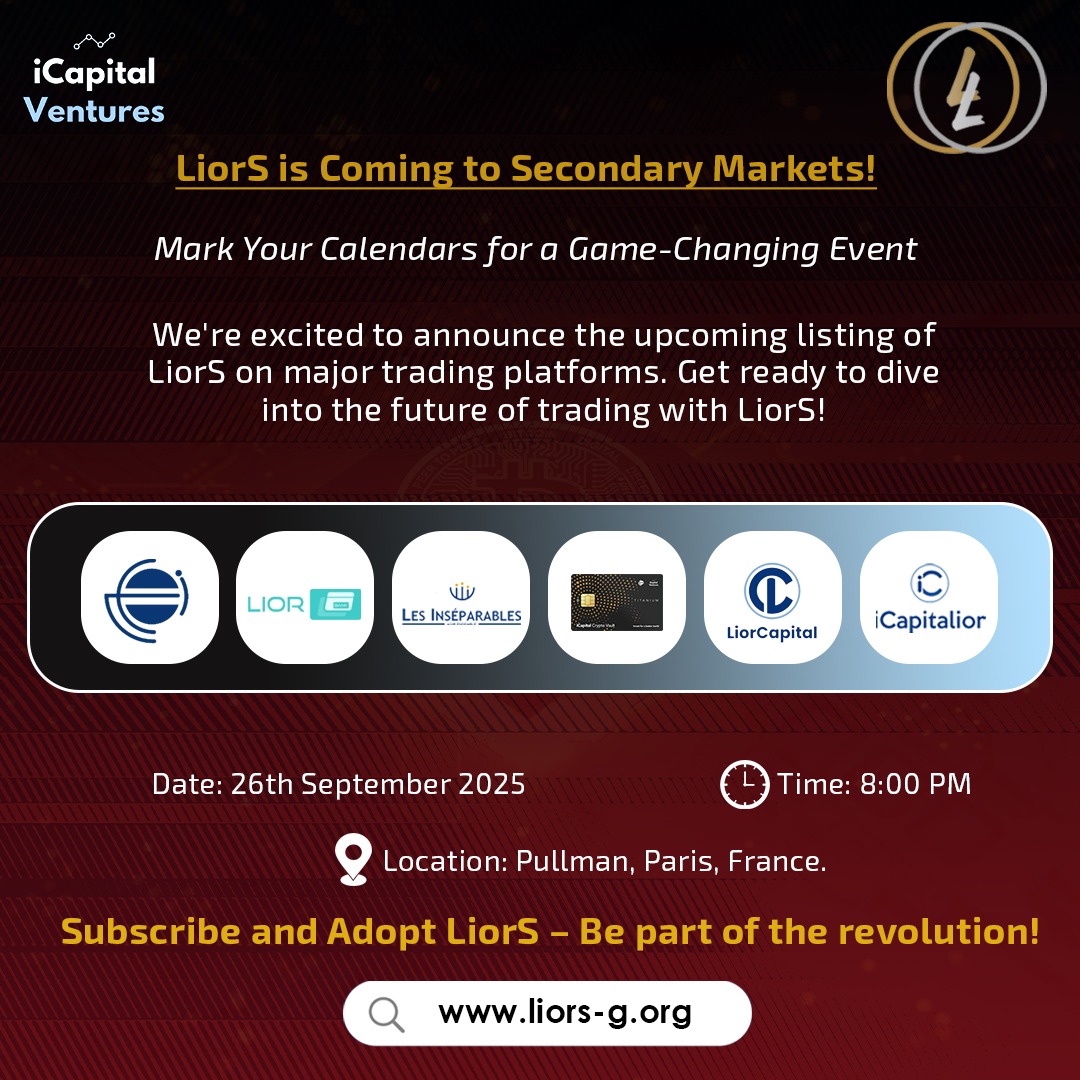

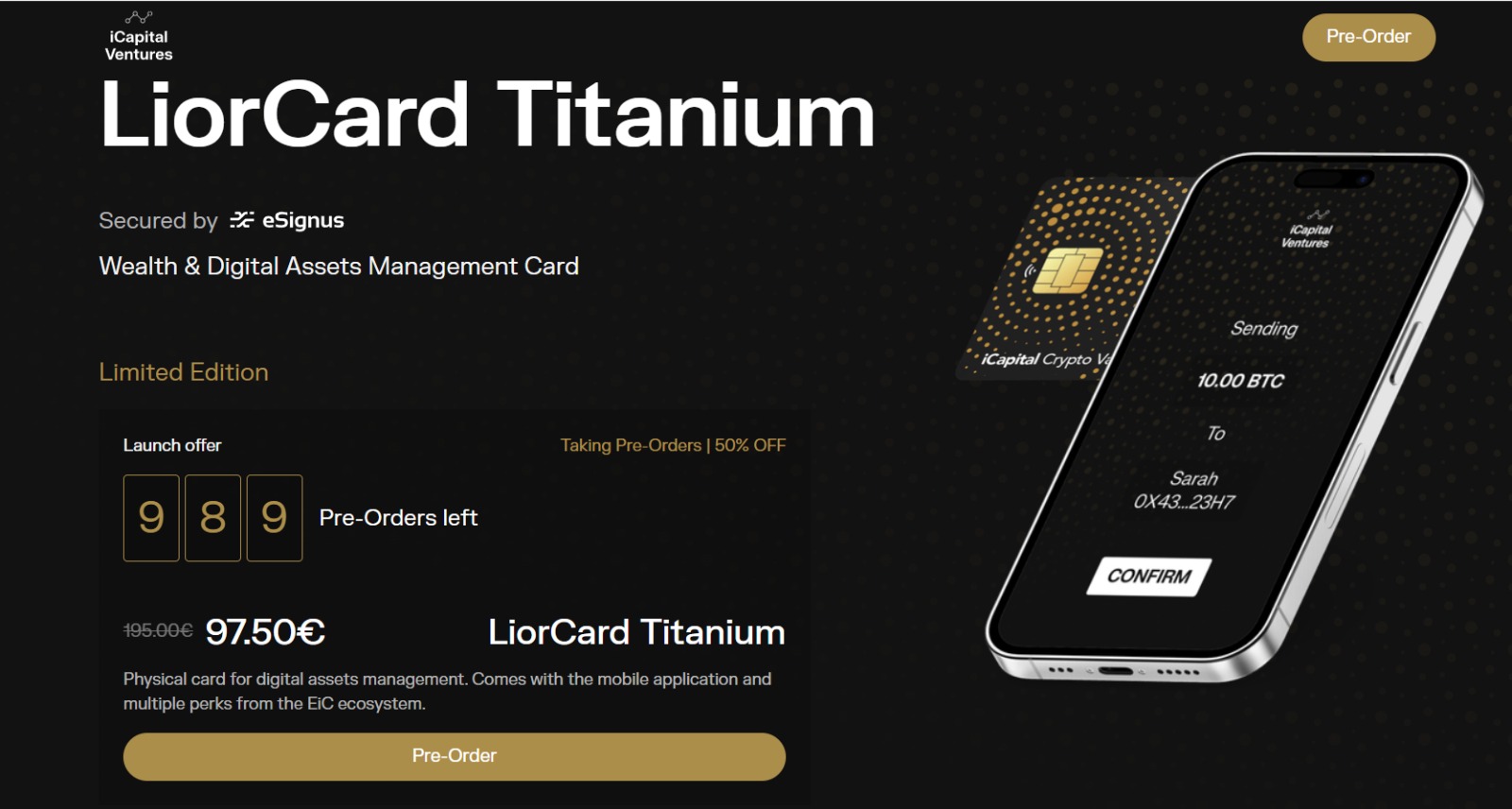

✔ Tokenization & Digital Assets

Leveraging blockchain infrastructure to create liquidity, transparency, and operational scalability.

✔ Investment Engineering

Structuring tailored OPEX/CAPEX instruments aligned with SME growth cycles.

✔ Economic Inclusion & Alternative Finance

Opening new pathways for under-served markets and high-potential ecosystems.

Through this configuration, the iCV Participation positions iCapital Ventures as a decentralized private investment bank, bridging:

• traditional capital markets,

• and emerging digital asset infrastructures.

This dual positioning strengthens our capacity to finance real-economy growth while pioneering next-generation investment models.

3. Opening the Fund to Institutional and Private Investors

With its launch, the iCV Participation is now accessible to a select group of investors seeking diversified, impact-driven and innovation-driven opportunities, including:

• Institutional Investors

• Family Offices

• High-Net-Worth Individuals (HNWI)

• Qualified Private Investors

These stakeholders gain exposure to a multi-layered investment strategy focused on operational resilience, capital efficiency, and international expansion.

4. Join the Onboarding & Access the Investor Deck

Investors and partners interested in joining the iCV Participation can submit their onboarding request and receive the official Investment Deck via the following link:

👉 Onboarding Form:

https://docs.google.com/forms/d/e/1FAIpQLSeXVoPG9TWCmjjkMtpvjckbsygvPik9bYZldwk2ypsLZGmO-Q/viewform

5. The Future of Decentralized Investment Banking Starts Now

The launch of the iCV Participation is more than the creation of a new vehicle — it is the beginning of a new era in our ecosystem.

An era where:

• capital mobilization becomes frictionless,

• SMEs access structured OPEX/CAPEX financing with transparency,

• digital finance unlocks global market integration,

• and private investment evolves toward a decentralized, inclusive and high-performance framework.

The future of decentralized investment banking has officially begun and it starts here.

Share

00 Comments

No Comments found!